IRS Releases First Round of Proposed GILTI Regulations

The calculation of tested income and tested loss of a CFC:

- The tested income and tested loss of a CFC are generally calculated by treating the CFC as a U.S. corporation;

- In determining the tested income of a CFC, no deductions are allowed for net operating loss carryovers and capital loss carryovers;

- The exception from tested income for "high-taxed income" only applies to gross income that would otherwise have been Subpart F income if the U.S. shareholder had not elected to exclude it under the high-tax exception;

- Quarterly averaging rules for determining the tax basis in tangible assets;

- The calculation of items necessary to determine the amount of interest expense that reduces net deemed tangible income return (based on QBAI).

Other Items of Note:

- The aggregation of the U.S. shareholder's pro rata share of GILTI to determine the actual GILTI inclusion amount;

- The same translation rule that is used for Subpart F income is applied for translating a pro rata share of tested income, tested loss, tested interest expense, tested interest income and QBAI;

- The treatment of domestic partnerships and their U.S. and foreign partners including a taxpayer-favorable rule for determining a partner's share of the "specified tangible property" of a partnership;

- The treatment of the GILTI inclusion and subsequent adjustments to stock basis related to tested loss CFCs;

- Determination of GILTI amounts for consolidated groups;

- Treatment of GILTI is the same as Subpart F income for purposes of Section 1411 (3.8 percent tax on net investment income);

- Anti-abuse rules for certain transactions that would otherwise result in a tax basis step-up to specified tangible property;

- The proposed regulations (once issued in final or temporary form), would generally be effective for taxable years of foreign corporations beginning after December 31, 2017, and to taxable years of U.S. shareholders in which or with which such taxable years of foreign corporation's end. The comment period on the proposed regulations ends November 12, 2018.

As helpful as this guidance may be for taxpayers, there are still numerous key issues that remain unaddressed (including whether certain provisions in the proposed regulations are inconsistent with the statute). The proposed regulations fail to discuss expense allocations for foreign tax credit purposes as they pertain to the GILTI regime, as well as the Code Section 250 (GILTI and FDII) deductions, amongst other issues that taxpayers are facing. The preamble to the proposed regulations does, however, mention that the Code Section 78 gross up which arises based on GILTI taxes deemed paid should be allocated to the GILTI basket which is good news to taxpayers.

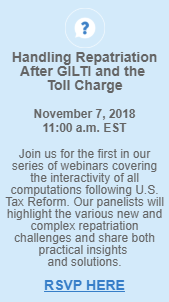

Stay tuned for insights and commentary on these regulations in the coming weeks and join us in anticipation as we await the next set of regulations.