IRS Issues New Non-Binding Guidance on NOL Carrybacks

Yesterday, the IRS released new questions and answers (Q&As) without much fanfare providing information for C corporations that carry back net operating losses to pre-TCJA years in which the alternative minimum tax (AMT) applies. The Q&As answer some outstanding questions taxpayers and their advisors have had about the effects of carrybacks to AMT years, but also potentially raise new issues that cannot be resolved without further guidance.

AMT and the Minimum Tax Credit

Prior to TCJA, corporations, like other taxpayers, were subject to the AMT. The amount of the AMT was generally calculated as the excess, if any, of the taxpayer’s tentative minimum tax (TMT) over its regular tax for the taxable year. In the case of corporations, the TMT was calculated by multiplying the taxpayer’s alternative minimum taxable income (AMTI) by 20%. The AMTI is the taxpayer’s taxable income calculated with certain adjustments. One such adjustment is that instead of being entitled to a deduction for its regular tax net operating loss (NOL), the taxpayer is entitled to a deduction for its AMT net operating loss (ATNOL), which is discussed in greater detail below. Therefore, as a result of carrying back an NOL, a taxpayer may be subject to, or may increase the amount of, the AMT.

If a taxpayer has to pay AMT in a taxable year, then they are eligible for a minimum tax credit (MTC) in a subsequent year. The MTC is generally a non-refundable credit (i.e., taxpayers can offset their regular tax liability but not obtain a refund as a result of the credit). However, because the AMT is no longer being imposed on corporations, the TCJA, as further modified by the CARES Act, provides that corporations claim a refundable credit equal to their MTC either entirely in the taxpayer’s taxable year beginning in 2018, or 50% in the taxpayer’s taxable year beginning in 2018 and 50% in the taxpayer’s taxable year beginning in 2019.

Ability to Claim Non-refundable MTC

As noted above, when a taxpayer carries back an NOL, the taxpayer may be subject to, or may increase the amount of, the AMT that is imposed, which in turn generates an MTC. That MTC can be used in subsequent years to reduce a taxpayer’s previously paid tax (and generate a refund, although the MTC is still non-refundable). As discussed previously, the Form 1139 may be preferable because it is processed more expeditiously. However, the Form 1139 Instructions provide that an MTC that results from an NOL carryback cannot be claimed on the form and instead, a taxpayer has to file an amended return. The Q&A that was released yesterday changes this rule and provides that the Form 1139 can be used to claim the non-refundable MTC. The MTC refund can be claimed on the same Form 1139 used to claim a refund for the NOL carryback. This change is a taxpayer-favorable rule which will hopefully accelerate the time in which the taxpayer can receive its refund.

ATNOL

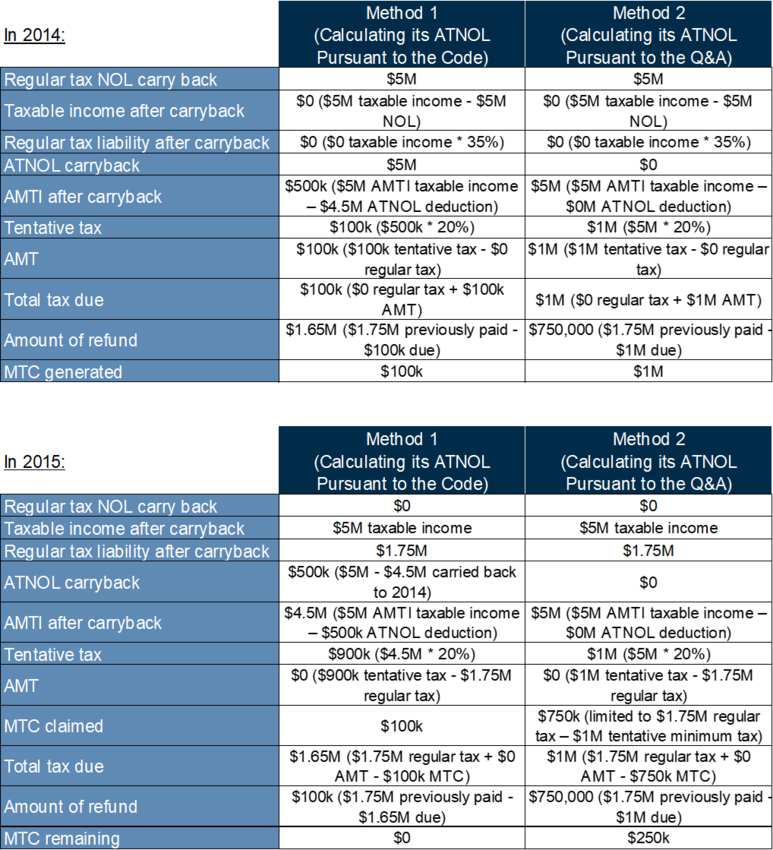

As noted above, in calculating its AMTI, a taxpayer has to determine the amount of its deduction for its ATNOL. As a result, the taxpayer has to first calculate its ATNOL and then potentially subject it to applicable limitations (generally 90% of pre-ATNOL deduction AMTI). The Code provides that for all taxable years beginning after December 31, 1986, the ATNOL is equal to the regular tax NOL after making certain adjustments. Neither the TCJA nor the CARES Act changed this definition within the Code. Therefore, despite the fact that corporations would not have the AMT imposed upon them for taxable years beginning after December 31, 2017, it would appear that taxpayers having an NOL eligible for carryback from a post-TCJA year must also compute an ATNOL for that year and carry it back (Method 1).

However, the Q&A released yesterday provides a different result: for purposes of computing AMTI as a result of a carry back of an NOL generated in a taxable year beginning after December 31, 2017, the amount of the ATNOL is treated as zero (Method 2).

It is important to note that regardless of which Method is applied, the taxpayer should receive the same amount of tax refund in the aggregate. The difference between the Methods is generally a matter of for which year the refund is being generated. This could be problematic for taxpayers because the IRS is allowed to examine each year that is amended, which could reduce the amount of the anticipated refund for a particular year. (An example demonstrating the application of the two methods can be found at the end of this alert in the Appendix.)

Impact of Not Utilizing Method 2

The Q&A provides that taxpayers that use a method other than Method 2, could cause the processing of their refund claim to be delayed. As a result, taxpayers are left with the quandary of following the Code and applying Method 1, which may delay the processing of their refund claim, or following the Q&A and applying Method 2 and taking a position that appears to be contrary to the Code.

In the Q&A, the IRS acknowledged that taxpayers may have applied a method different than Method 2, and so it provides that taxpayers should not take any action, including refiling, if the taxpayer applied a non-Method 2 approach before June 1, 2020, unless contacted by the IRS.

A&M Taxand Says

As evidenced by these Q&As, the rules governing the manner of claiming refunds attributable to NOL carrybacks and AMT credits, as well as the timing of those claims, are intricate and potentially confusing. The position taken by the Q&As on ATNOLs may operate for or against the taxpayer, but in any case, will require careful analysis and modeling to enable the taxpayer to decide how to proceed. Additionally, it is important to keep in mind that the Q&As are informal guidance and therefore, cannot be relied upon as legal authority and are subject to change (as we have seen in other areas of CARES Act informal guidance). Alvarez and Marsal stands ready to assist clients with any of these determinations. We will continue to monitor developments and will discuss any further changes in these rules in a future alert.

Appendix

Example: In 2019, X, a C corporation generates a $5M regular tax NOL. If X calculated its ATNOL pursuant to Code, it would have an ATNOL of $5M. In 2014, 2015, and 2016, X had both taxable income and AMTI (before an ATNOL deduction) of $5M and paid tax of $1.75M ($5M * 35%).

As a result, under Method 2, X will need to amend its 2016 tax return in order to claim the remaining $250,000 of MTC.