Independent Electric Vehicle Manufacturer Liquidity Comes into Focus as Major OEM Partnerships and Growth Tracks Solidify

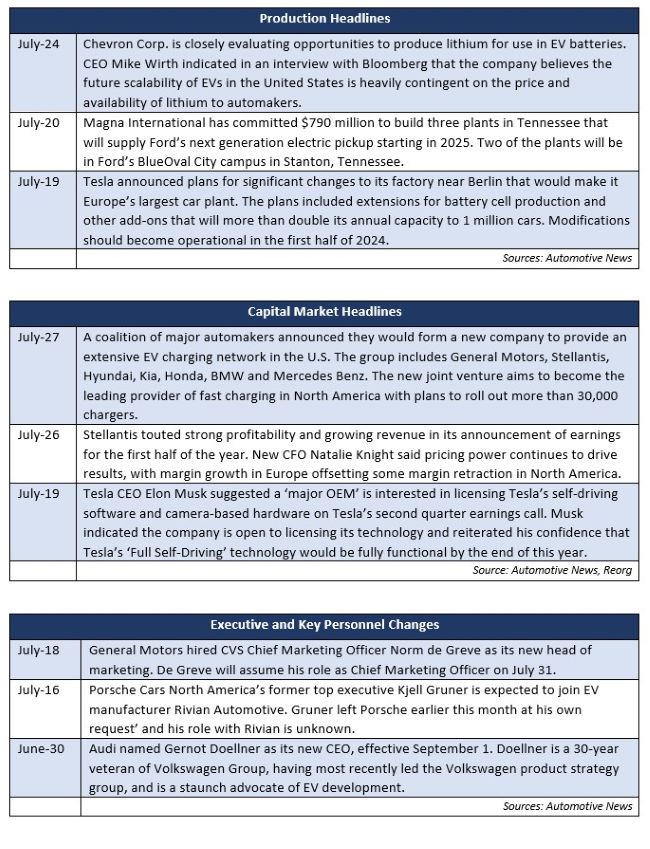

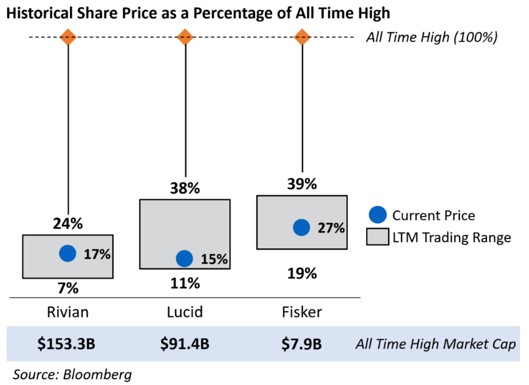

Major automakers announce a historic electric vehicle (EV) charging network joint venture. Tesla announces solidified plans for expanding its Berlin factory to become the largest automotive plant in Europe. EV inventory sales turnover lags its internal combustion engine (ICE) counterpart by a significant margin at dealerships, signaling a slowdown in sell-through demand for EVs.

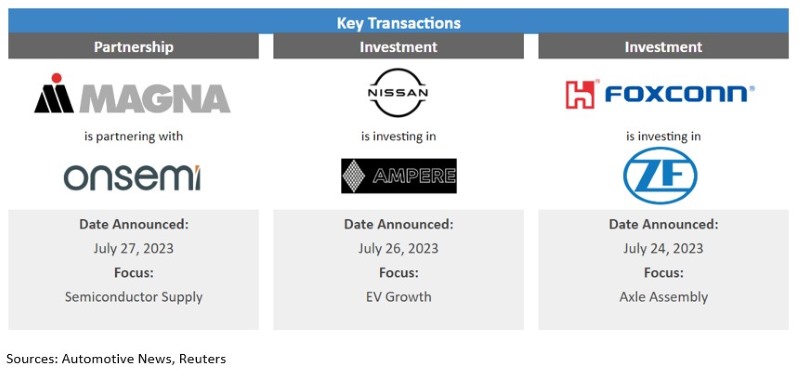

In transaction news, Magna International is partnering with Onsemi to secure its semiconductor supply for years to come. Nissan is investing in Renault’s EV spinoff, Ampere, to grow its EV presence in Europe. Foxconn is investing in ZF Group’s axle unit, looking to accelerate alternative automotive and supply chain opportunities.

In regulatory news, United Auto Workers (UAW) President Shawn Fain met with President Joe Biden to provide updates on the labor union’s contract negotiations. The National Highway Traffic Safety Administration (NHTSA) announced a new special probe into a fatal Tesla accident from 2018, where the company’s self-driving technology is suspected to have been in use. A Fiat Chrysler engineer pleaded guilty to charges of making false statements to regulators with regards to the company’s diesel engine emission control systems.

Additional July insights are included below.

Financial Performance

The global semiconductor shortage topped 1.45 million vehicles cut from automakers’ production plans for this year, according to AutoForecast Solutions (AFS). AFS now expects approximately 2.5 million vehicles will be cut from production plans for lack of chips in 2023, an improvement from its prior forecast of 2.6 million. The shortage contributed to production cuts of 4.38 million vehicles and 10.56 million vehicles in 2022 and 2021, respectively.

Industry Update

June inventory levels ended at 1.91 million units, a slight increase from last month. Days’ supply (DS) closed at 40, approximately 8 percent below the five-year average and a slight improvement over the last several months.

A recent Cox Automotive study revealed that EVs sit on dealer lots nearly twice as long as ICE vehicles, despite significant financial incentives to purchase EVs. On average, EVs took 92 days to sell during the second quarter of 2023, compared to 54 days for ICE vehicles. The consensus among dealerships within the study was that increased optionality on EV models and high prices are causing a slowdown in sell-through demand. The study also revealed that EV inventory is up 350 percent year to date compared to last year and comes on the heels of several EV price cuts led by Ford (notably on the Mach E and Lightning models).

June U.S. light vehicle sales increased approximately 20 percent year over year, above consensus estimates from Bloomberg. Vehicle mix continues to remain near record levels, trending toward large vehicles, as average transaction prices remain steady but elevated compared to this time last year. Expectations for full year 2023 remain moderate based on continuously growing production cuts and an increasingly unstable near-term macroeconomic environment, but signs continue to point toward a steeper recovery in 2024.

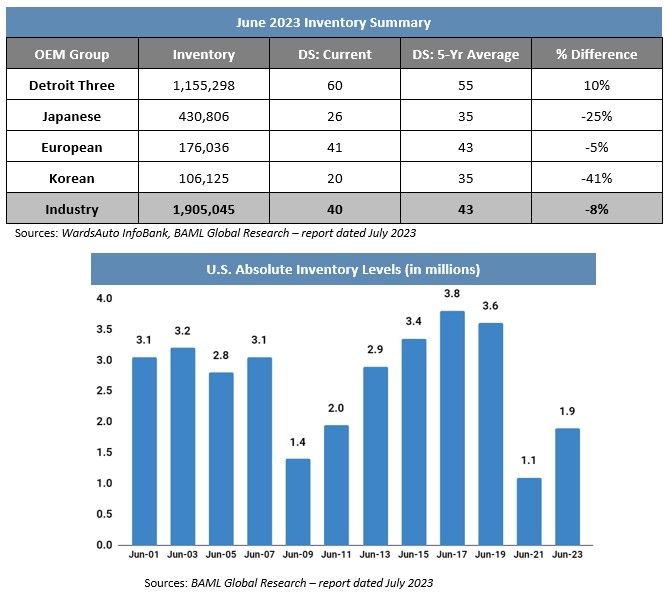

Industry Focus — Independent EV Manufacturer Liquidity

As major automotive manufacturers ramp up efforts to grow EV production and sales, independent and ‘startup’ EV manufacturers have experienced mixed results. While Tesla stands out as a major success story among independent EV makers, others like Rivian, Fisker and Lucid Motors have publicly faced liquidity issues while improving production capabilities and growing sales. In the last several months, each of these independent EV manufacturers has announced plans to raise a combined $5 billion.

While working capital growth is a consistent theme in each automaker's plans for funds raised, the announcements come in the face of mounting operating losses and limited cash runways for each manufacturer. EV manufacturer liquidity is under particularly intense scrutiny on the heels of Lordstown Motors’ Chapter 11 bankruptcy filing.

Fundraising isn’t new, but circumstances have changed

Since 2009, the trio of Rivian, Lucid Motors and Fisker have raised a combined $37 billion from private and public markets. More than 99 percent of those funds were raised after the second quarter of 2018. Capital allocated to the broader EV market has grown steadily in recent quarters and is not expected to slow down. (See our prior analysis of the capital commitments made toward EV development here.)

Recently, difficult macroeconomic conditions and an unsteady consumer marketplace have thrust independent EV manufacturers’ results and cash runways into the spotlight. While each manufacturer has cited working capital growth as the primary use of new funds raised, reductions to production forecasts and increased commitments to marketing dollars paint a more bearish picture for independent EV manufacturers.

Pricing pressure in early 2023 from large EV manufacturers — most notably Ford and Tesla — has hit growing independent EV manufacturers particularly hard. Rivian cut 6 percent of its jobs amidst pricing pressure in February 2023 after cutting a similar percentage of its workforce in July of 2022.

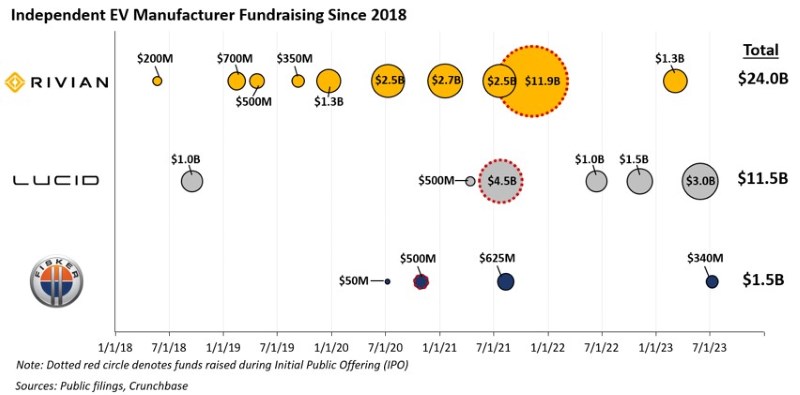

Independents are a long way from their respective tops

Pricing pressures, layoffs and production cuts have sent independent EV manufacturer stock prices tumbling from their respective all-time highs in the last twelve months. Rivian, Lucid and Fisker have all reached all-time low market cap values in the last four months. While broader macroeconomic conditions have not been conducive to share price rallies, increased skepticism and very public struggles have put specific pressure on independent EV manufacturers.

In a particularly stark example, Rivian’s market cap experienced a decline of nearly 93 percent from an all-time high of more than $153 billion. However, the news has not been all sour in recent weeks. Since reaching its all-time low in April, Rivian’s share price has more than doubled on news of deliveries beating estimates, reaffirmation of full year targets and the announcement of access to Tesla’s charging network.

How long can the runway extend?

While there is near-term optimism for Rivian, Lucid and Fisker based on their reaffirmed full year targets for production and deliveries, lingering questions about cash burn rates and longer-term liquidity linger. Rivian has experienced negative cash flows of $1 billion or more in every quarter since Q2 2021 (including $6.3 billion total for full year 2022), and consensus forecasts expect that trend to continue through the end of 2024. Without incremental fundraising, the company would run out of cash by the end of 2025.

Lucid, while backed largely by Saudi Arabia’s Public Investment Fund, faces similar concerns. The company ended the first quarter of 2023 with nearly $3 billion cash on hand (and raised another $3 billion in the second quarter). But, like Rivian, it has burned through nearly $1 billion in cash per quarter for the last several quarters.

Cash runway concerns are especially prevalent in the face of Lordstown Motors’ Chapter 11 bankruptcy filing at the end of June. While the company’s situation was exacerbated by its ongoing dispute with Foxconn regarding the sale of one of its factories, liquidity concerns crippled the company’s ability to operate.

Transaction Activity

Magna International has announced a 10-year agreement with silicon carbide microchip manufacturer Onsemi. Nissan will invest more than $600 million in Renault’s EV-spinoff Ampere under the longstanding alliance’s new terms. Foxconn will acquire 50 percent of ZF Group’s axle assembly unit.

See below for additional details on recently announced transactions.

- (7/27) Canadian supplier Magna International has entered a 10-year agreement for silicon carbide microchips from semiconductor manufacturer Onsemi. The companies plan to produce tens of millions of units over the course of the agreement and comes as other suppliers are actively seeking sources for silicon carbide chips for use in EV components. The value of the deal was not disclosed.

- (7/26) Nissan will invest up to $663 million in Renault’s Ampere EV spinoff. Nissan’s role as a strategic investor with a board seat is part of a now finalized deal to restructure the companies’ longstanding alliance. The investment strengthens Nissan’s push to grow its electric presence in Europe and will deliver synergies in cost, regulatory compliance and powertrain offerings.

- (7/24) Foxconn plans to acquire a 50 percent stake in ZF Group’s axle system assembly unit. The joint venture aims to grow automotive and supply chain opportunities and values ZF chassis modules at one billion euros. ZF plans to use the proceeds to reduce its existing debt load and is expected to become effective within nine months, pending regulatory approvals.

Regulatory Landscape

UAW White House Visit: UAW President Shawn Fain met with President Joe Biden earlier this month to discuss the state of labor contract talks with automakers. The meeting comes as Fain has, notably, not endorsed President Biden’s reelection campaign and has publicly criticized certain EV policies the administration has pushed.

NHTSA Opens New Tesla Probe: The NHTSA announced a special probe into a fatal 2018 accident in California involving a Tesla Model 3 where advanced driver assistance programs were suspected to be in use. Since 2016, the NHTSA has opened more than three dozen special investigations into fatal Tesla crashes where driver assistance programs were reportedly in use.

Stellantis Diesel Emissions Probe: A Fiat Chrysler engineer charged with making false statements to U.S. regulators about diesel engine emission control systems pleaded guilty to felony charges earlier this month. The guilty plea is in line with an earlier conviction of Fiat Chrysler (now part of Stellantis) for defrauding the EPA and customers. Fiat Chrysler has previously paid more than $300 million in criminal penalties because of efforts to evade emissions requirements.

Stay connected to industry financial indicators and check back in August for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive