May 17, 2022

German M&A Trends 2022

Q1 2022:

Whilst the world runs from one crisis to another crisis, the M&A market is still keeping a high pace, however, first signs of a slowdown are on the horizon – higher volatility with respect to deals coming and going (the number of deals that A&M is engaged with is a record high, but so is the amount of deals that never start) plus the number of aborted transactions is significantly increasing.

- Last year ended with a very large transaction in Switzerland with Sika AG acquiring Master Builders Solutions Deutschland GmbH exited by LoneStar. This roughly 5bn CHF deals signals that the Chemicals sector is still hot.

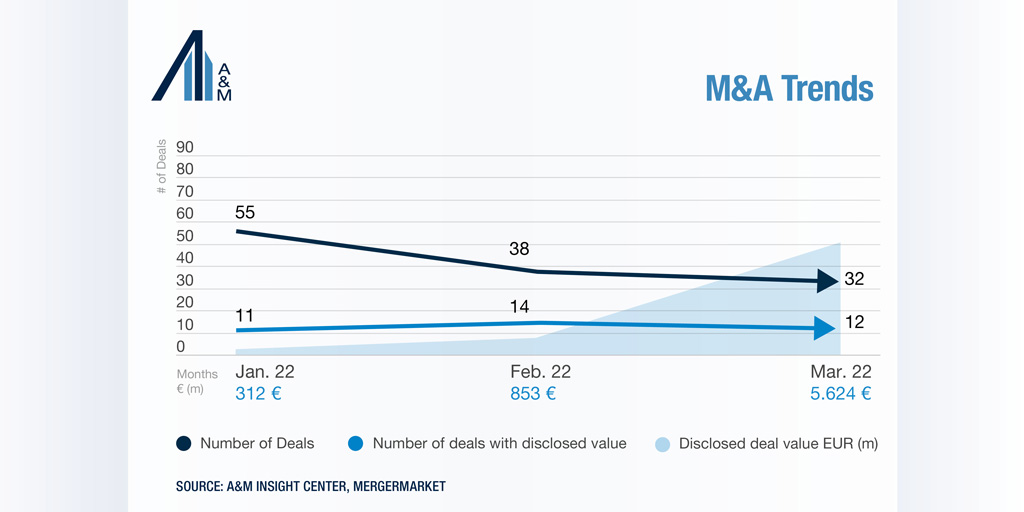

- Q1 FY22 started with the same pace compared to end of last year and comparable quarter in FY21. Only in March was FY22 weaker (by number of deals) with 32 announced deals compared to 53 deals in March FY21.

- However, the overall deal value in Q1 FY22 was only around 70% of Q1 FY21 – an indication that on the smaller end of the market activity is still high whereas larger deals are more rare.

- The largest deals in Q1 FY22 are the acquisition of Berlin Hyp, the successful sale of the Siemens postal logistic business to Körber as well as the acquisition of Lewa GmbH, a manufacturer of pumps.

- Valuations are still in a “red zone” – still very high and double-digit multiples are the norm. It will be very interesting to watch the upcoming months whether we see the existing high valuations as recurring level or whether the market will come down.

- There might be mid-to longer term impacts resulting from the supply chain problems due to the war in Ukraine. Not to mention the potential implications resulting from the discussed and potentially required shift in the energy and gas market.

It has never been more interesting than today to watch, discuss and be part of the PE market.