Executing Carve-outs without IT TSAs: A Strategic Approach

While IT Transition Service Agreements (TSAs) are traditionally used to ensure the continuity of IT services post-transaction, they can often introduce complexities that frustrate or hinder the carve-out process. We at Alvarez and Marsal (A&M) observe an increase in the number of transactions which are structured to minimise IT TSAs, or avoid them altogether. This presents organisations with a compelling opportunity to enhance strategic flexibility, allowing for a quicker, cleaner break from the seller.

Why pursue a zero IT TSA Approach?

A faster path to value creation…

Standalone Target IT Environment: One of the most compelling advantages of a zero IT TSA approach is the ability to offer a fully standalone IT environment for the carved-out entity, free from dependency on the parent company’s infrastructure. This independence means the buyer can take full control of IT operations and capture operational synergies more quickly, while minimising disruption.

Reduced Complexity and Management Overhead: IT TSAs introduce additional management burdens as sellers become temporary service providers for the divested entity. This creates governance challenges, introduces the potential for inconsistent service levels, and adds complexity that could lead to missed deadlines or business disruptions.

Eliminating Stranded Costs from Closing: Without IT TSAs, sellers can begin eliminating IT stranded costs from day one. Stranded costs, which arise when the parent company is left with underutilised assets or services post-divestiture, are a significant financial burden that can be mitigated by avoiding extended TSA periods.

Earlier Synergy Capture and Control: By avoiding a TSA, buyers can immediately begin integrating, optimising, or upgrading IT systems to fit their operational needs. This early capture of IT synergies can significantly enhance the value of the acquisition, reducing time lost decoupling from the seller’s systems and processes.

Data Segregation and Compliance: Sensitive data from the divested entity can be segregated from the parent’s systems prior to closing, which is critical in supporting legal and regulatory compliance, particularly in industries with strict data protection laws (e.g., GDPR, HIPAA). Avoiding TSAs here can help ensure that both parties meet their legal obligations without prolonged exposure to data privacy risks.

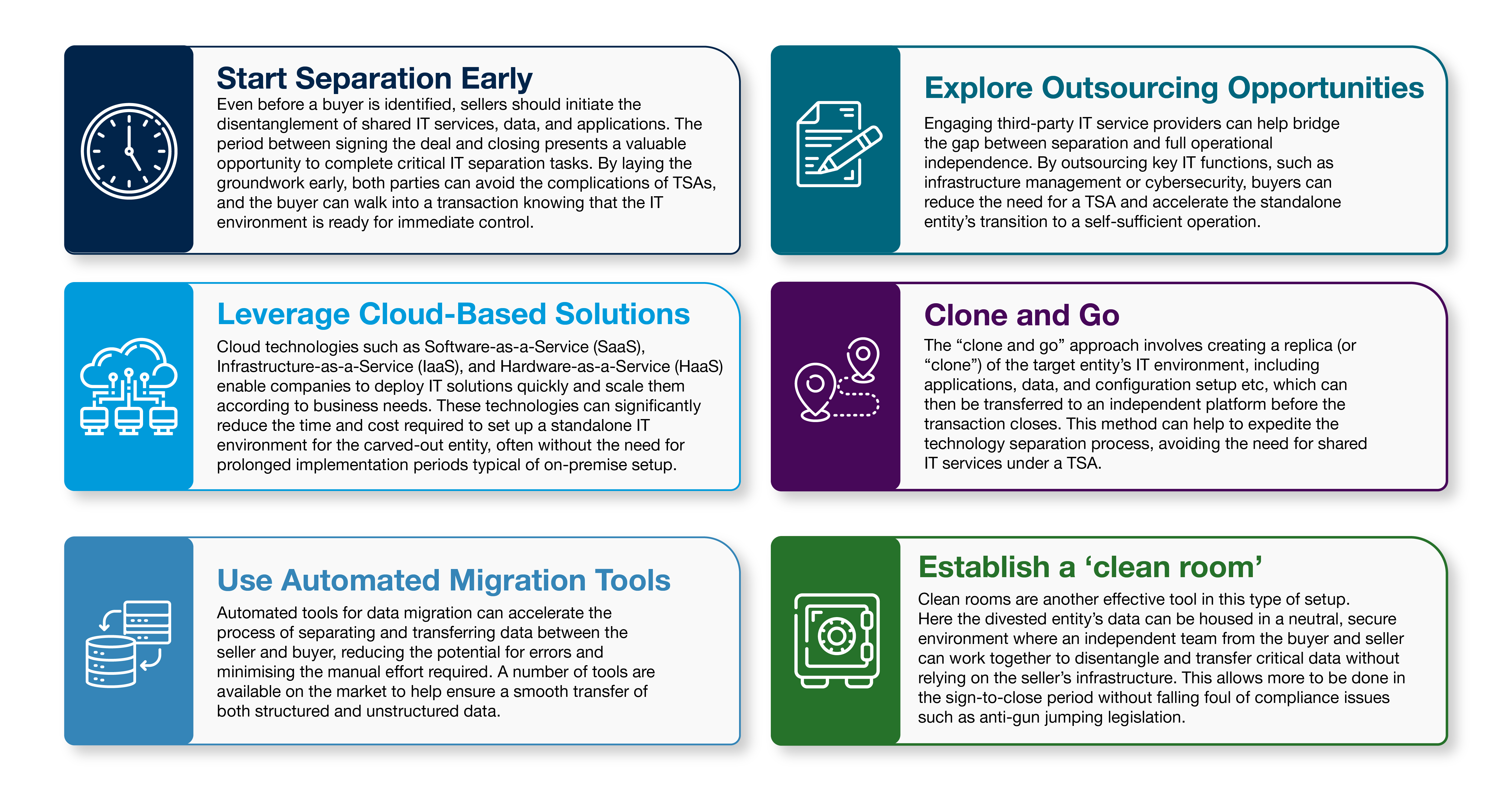

How can IT TSAs be avoided?

A practical question that often arises in the context of carve-outs is, how can IT TSAs be avoided? In our experience working with clients there are some key foundation blocks which can help lay the groundwork:

While the benefits of a zero IT TSA approach are significant, it also introduces specific risks that organisations must be aware of and manage effectively:

Upfront Investment:

A zero IT TSA approach often requires significant upfront investment in IT infrastructure and separation activities before the deal is signed.

Prolonged Sign-to-Close Period:

Implementing a standalone IT environment upfront may extend the time required between signing the deal and closing. This longer period may be less appealing to both buyers and sellers, particularly when other deal factors require swift execution.

- Misalignment of IT Solutions:

A zero IT TSA approach often requires significant upfront investment in IT infrastructure and separation activities before the deal is signed.

- Prolonged Sign-to-Close Period:

Implementing a standalone IT environment upfront may extend the time required between signing the deal and closing. This longer period may be less appealing to both buyers and sellers, particularly when other deal factors require swift execution.

- Misalignment of IT Solutions:

Buyers may inherit IT solutions from the seller that do not align with their long-term strategy, leading to wasted effort and potential rework as the buyer replaces or modifies the inherited systems to fit their operational needs. This is particularly true with a trade buyer who may already have their own IT standards, system preferences and M&A playbook.

- Loss of Knowledge Transfer:

IT TSAs often serve as a bridge for transferring knowledge about the divested entity’s IT systems and operations. Without a TSA, there is a risk of losing institutional knowledge during the separation, particularly if key IT staff who managed the divested entity’s systems remain with the seller.

- May force some big-bang style changes:

The absence of a controlled or extended IT TSA period may require system cutovers across multiple systems, in a ‘big bang’ style approach (e.g. in order to maintain certain integrations) that can increase the risks associated with any technology project.

Summary

Zero IT TSA carve-outs represent a shift from how organisations traditionally structure their IT M&A projects. While adopting these principles can enhance speed and flexibility during a carve-out, it also introduce complexities that must be weighed against the benefits and deal specifics to assess its viability. We have seen both buyers and sellers realise significant value from this type of structure, particularly in deals where speed is critical and the buyer is a financial investor (non-trade buyer).

About Alvarez & Marsal Business Technology

The Alvarez & Marsal (A&M) Business Technology team brings a commercial focus to solving complex technology issues. Our team, which includes many former CIOs, domain experts and industry leaders, brings leadership and expertise to help turn strategy into execution.

A&M Business Technology can provide end-to-end Technology M&A advisory services to private equity clients, their portfolio companies, as well as to corporate clients. Services cover the complete M&A portfolio, from technical due diligence, carve out and post-merger integration services, through to technology transformation, value creation (cost-out) and interim CIO support.

We work in all industries and sectors, helping maximise the benefits of M&A transactions, optimise technology, streamline processes, reduce costs and accelerate value creation.