The Emerging Role of Health System C-suite Executives as Hospital Portfolio Managers

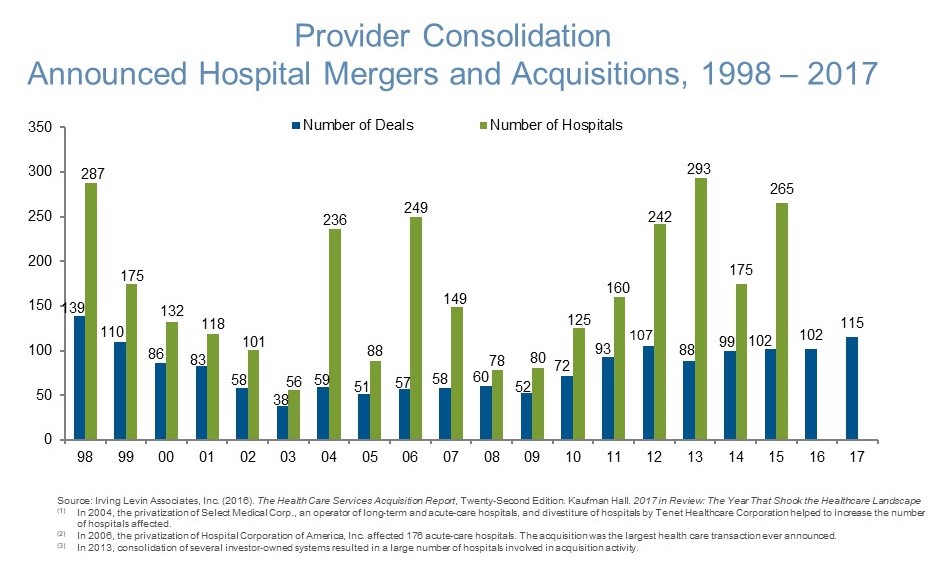

Health system and hospital consolidation continued unabated in 2017 and the 1Q2018, consistent with the merger and acquisition trends of the prior five years. Growing concerns with health system debt levels, combined with divestitures by Community Health Systems and Tenet have not tempered the consolidation trend.1,2 Among the touted benefits associated with consolidation include economies of scale, efficiencies, care standardization and enhanced outcomes. Higher prices also result in markets with competitive concentration.

In this article, we discuss the emerging role C-suite executives as portfolio managers of their hospital and non-hospital assets and the strategic alternatives available to maximize asset value.

Standalone hospitals are disappearing

The majority of U.S. hospitals are already in a multi-hospital system (68 percent) and/or network (35 percent), the latter defined by the American Hospital Association as “a group of hospitals, physicians, other providers, insurers and/or community agencies that work together to coordinate and deliver a broad spectrum of services to their community.”3 During the past 12-18 months, mergers have been announced by Bon-Secours and Mercy Health, Catholic Health Initiatives and Dignity Health, Carolinas and UNC, Greenville and Palmetto, and Advocate and Aurora.4,5,6,7,8 Approximately one-half of these mergers are focused in a single state, whereas others reflect the emergence of “super-regional” health systems often in contiguous states. Based on the trends that we have been tracking at Alvarez & Marsal (A&M), hospital merger and acquisition activity accelerated with enactment of the Affordable Care Act (“Obamacare”) on March 23, 2010.9

Not all hospital mergers have been successful. In April 2016, Community Health spun-off Quorum Health as a 35-hospital system, and subsequently divested 30 additional hospitals; another 25 hospitals are targeted for sale in 2018.10,11 In November 2017, Tenet Healthcare announced plans to divest eight U.S. and nine U.K. hospitals, and restructure its minority interest in Baylor-Scott & White to raise $1.0 billion in capital.12 In contrast, HCA has been a selective buyer of CHS and Tenet hospitals, and other assets.13

Rationale for hospital consolidation in a flat-to-declining market

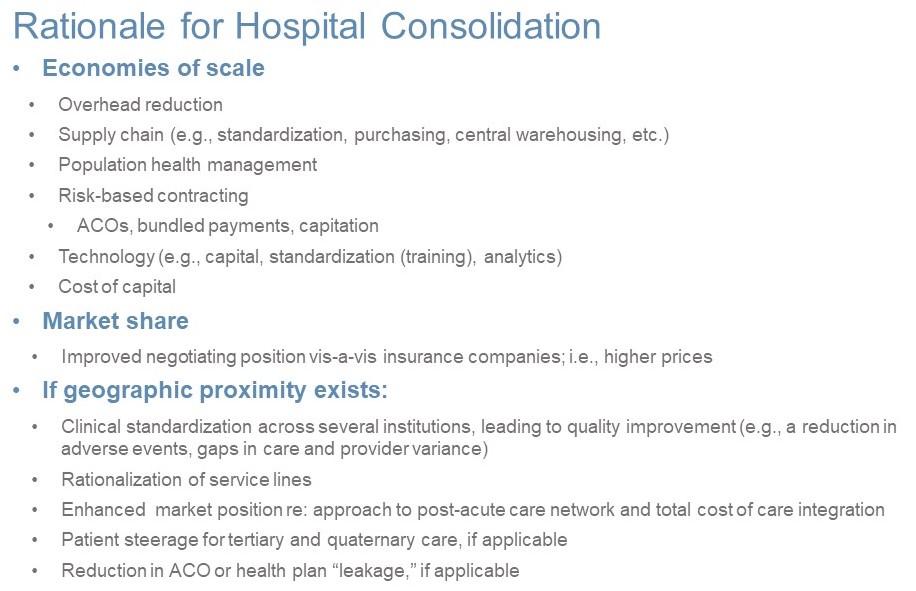

The rationale for hospital consolidation involves economies of scale and the potential for market share gain (i.e., higher prices), and to a lesser extent, clinical standardization, patient steerage and reduced system leakage. Economies of scale are realizable with a reduction in corporate overhead and supply chain cost, and leverage of technology investments. Population health management initiatives, focused on the 5-10 percent of the patient population accounting for 43-68 percent of costs, increase their effectiveness with the distribution of risk among larger cohorts.14

Market share has also been an important driver of hospital consolidation, particularly within overlapping local markets. Hospital consolidation has been shown in many studies and over several years to increase prices and thus, the cost of care; in concentrated markets potentially greater than 20 percent.15,16 Consolidation applies not only to hospitals, but also to physician practices, thereby replace with “strengthening referral sources” for hospital beds and higher cost outpatient services.

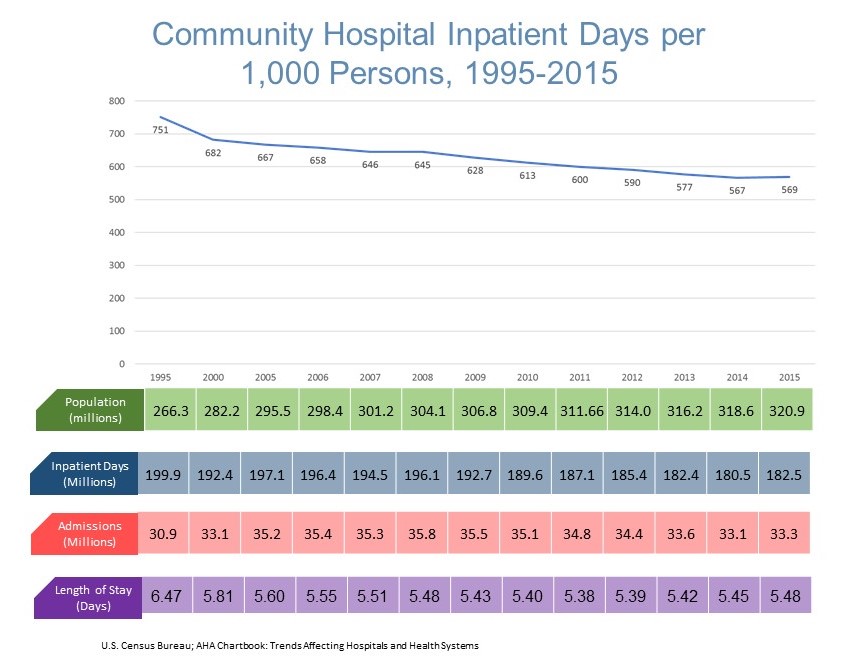

Inpatient days declined by 8.7 percent in 1995-2015, despite an overall population growth of 20.5 percent. The decline is more pronounced than indicated, as the percentage of the population >65 years increased by 43.1 percent during this period.17 Medicare FFS and Medicare Advantage beneficiaries accounted for nearly 14.0 million hospital admissions in 2016, representing 42.0 percent of the total.18,19

-

Decline in cardiovascular admissions by 25.2 percent in 2005-2014 driven by pharmaceutical intervention, medical technology, etc.

-

Shift in surgical volume from inpatient hospitals (2014: 7.8 milion, -6.8 percent) to outpatient/ambulatory surgical centers (2014: 9.9 million, +18.2 percent); future to potentially include joint replacement

-

Decline in hospital readmissions

-

Declining in rate of ambulatory care sensitive (preventable) admissions

-

Increased number of observation stays

-

Higher out-of-pocket costs and growth of high deductible plans impacting demand for elective procedures

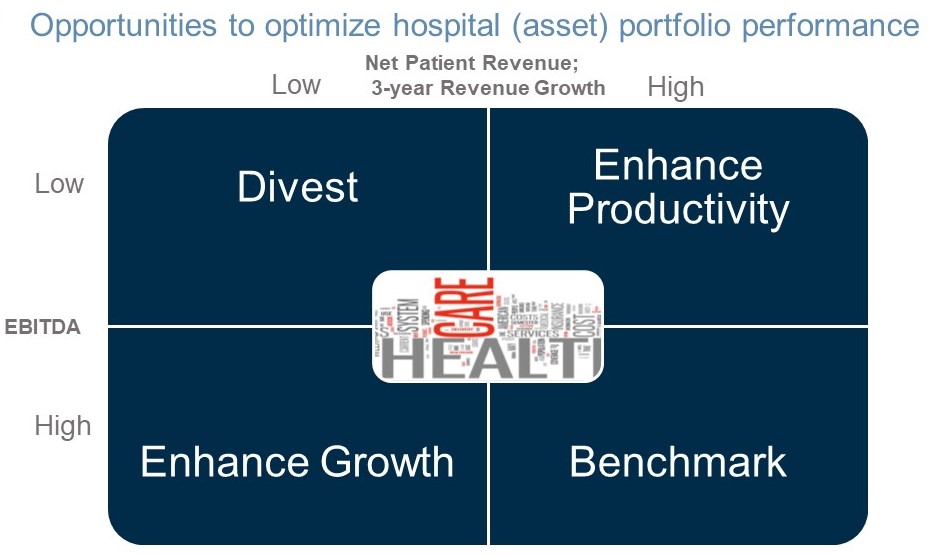

Portfolio management essential in the emerging healthcare ecosystem

C-suite executives will increasingly become portfolio managers focused on increasing growth, enhancing productivity and reducing the total cost of care. This includes rationalization of corporate overhead, and if necessary, hospital divestiture and/or closure. Under-performing assets often have a disproportionate influence on the financial performance of the entire system. The increase in national health expenditures by the Centers for Medicare and Medicaid Services (CMS) from $3.5 trillion in 2017 to $5.7 trillion in 2026, +62.3 percent is not sustainable.20 Eventual transformation to an at-risk, value-based healthcare delivery system is inevitable. Hospital and portfolio performance will increasingly matter.

1Community Health Systems selling Louisiana hospital; February 14, 2018. http://www.modernhealthcare.com/article/20180214/NEWS/180219954

2Tenet receives $550 million on divestitures in Q1; March 2, 2018 http://www.modernhealthcare.com/article/20180302/NEWS/180309972/

3AHA Fast Stats, 2018. https://www.aha.org/statistics/fast-facts-us-hospitals

4Bon Secours Health System and Mercy Health Announce Intent to Merge; February 21, 2018 https://bonsecours.com/richmond/about-us/newsroom/news/bon-secours-health-system-and-mercy-health-announce-intent-to-merge

5Dignity Health, CHI finally strike deal to form second largest nonprofit system; December 7, 2017 https://www.healthcaredive.com/news/CHI-dignity-health-merger/512530/

6Carolinas HealthCare System joining with UNC to form hospital giant; September 1, 2017 http://www.charlotteobserver.com/news/business/article170440017.html

7Greenville Health System and Palmetto Health combine to create largest health system in South Carolina; June 19, 2017 https://www.healthcarefinancenews.com/news/greenville-and-and-palmetto-health-systems-will-combine-create-largest-health-system-south

8Advocate Health Care finalizes merger with Wisconsin hospital system; April 2, 2018 http://www.chicagotribune.com/business/ct-biz-advocate-aurora-merger-done-20180403-story.html

9Irving Levin Associates, Inc. (2016). The Health Care Services Acquisition Report, Twenty-Second Edition.

10Community Health Systems Completes Spin-off of Quorum Health Corporation; April 29, 2016 https://www.businesswire.com/news/home/20160429006073/en/Community-Health-Systems-Completes-Spin-off-Quorum-Health

11CHS to sell off more hospitals this year. Healthcare Dive; January 12, 2018 https://www.healthcaredive.com/news/chs-to-sell-off-more-hospitals-this-year/514658/

13Tenet Planning to Divest 17 Entities in U.S. and U.K. Dallas Healthcare; September 12, 2017

13HCA to add 7 hospitals, looks to M&A for more growth; May 2, 2017

14Medicaid – CMS FY2008; Commercial - Kaiser Family Foundation calculations using data from U.S. Department of Health and Human Services, Agency for Healthcare Research and Quality, Medical Expenditure Panel Survey (MEPS), 2008.; Medicare – CMS 2001

15The impact of hospital consolidation —Update. RWJ Foundation; June 2012 https://www.rwjf.org/content/dam/farm/reports/issue_briefs/2012/rwjf73261

16Making health care markets work: Competition policy for health care. Brookings; April 13, 2017 https://www.brookings.edu/research/making-health-care-markets-work-competition-policy-for-health-care/

17U.S. Census Bureau

1834 statistics for Medicare admissions, costs, margins and charges at hospitals. Becker’s CFO Report; March 20, 2017 https://www.beckershospitalreview.com/finance/34-statistics-for-medicare-admissions-costs-margins-and-charges-at-hospitals.html

19Hospital Stays in Medicare Advantage Plans Versus the Traditional Medicare Fee-for-Service Program, 2013. HCUP Statistical Brief #198; December 2015 https://www.hcup-us.ahrq.gov/reports/statbriefs/sb198-Hospital-Stays-Medicare-Advantage-Versus-Traditional-Medicare.pdf

20CMS National Health Expenditures https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected.htm