CVS-Aetna Acquisition Not Leading to a New Model of Care Delivery

On December 3, 2017, CVS announced an intention to acquire Aetna for $69 billion. Its press release promoted the “combination to provide consumers with a better experience, reduced costs and improved access to health care.”1 CVS has 9,700 retail pharmacy locations, inclusive of 1,100 walk-in MinuteClinics. Other high-profile acquisitions by CVS include Omnicare in May 2015, a leading skilled nursing and assisted living dispenser of drugs; Coram in January 2014, a leader in specialty infusion services and enteral nutrition; and Caremark RX in November 2006, a leading pharmacy benefit manager.

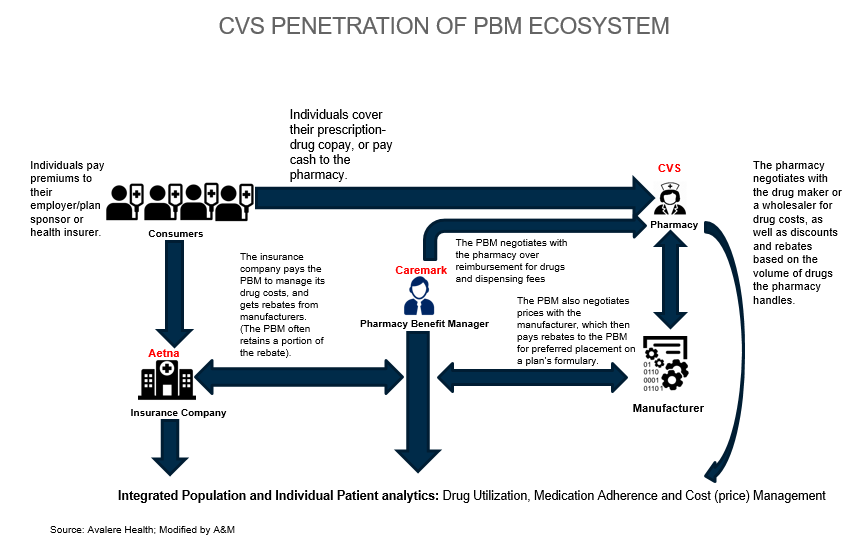

The Aetna acquisition represents a potential source of customers for its portfolio of offerings, however, contrary to what has been reported by a few in the press, it will not lead to a new model of care delivery. Both Aetna and CVS, as payers and drug retailers, are not directly involved in the provision of care. Higher prices are also likely as CVS, the leading drug retailer with 14.8 percent of prescription revenues, and Caremark, a leading mail order/specialty pharmacy (PBM) with 8.6 percent, are likely to increase their respective market share in an already consolidated market due to incremental Aetna pass-through volume.

A few thoughts:

“Combination to provide consumers with better experience.”

The recent J.D. Power 2017 U.S. Pharmacy Study found “decreases in satisfaction with brick-and-mortar pharmacies [are] driven by year-over-year declines in satisfaction with cost, which falls 27 index points to 789 (on a 1,000-point scale), and the in-store experience, a 14-point drop to 851. Decreases in satisfaction with mail order pharmacies are driven by declines in satisfaction with cost (-49 to 787) and the prescription ordering process (-15 to 877).”3

Until the rise in drug costs moderate, the consumer pharmacy and mail order experience is likely to decline or at best, remain stagnant.

Opportunities do exist, however, for CVS and other pharmacies to increase patient engagement, defined “as a concept that combines a patient's knowledge, skills, ability, and willingness to manage his own health and care with interventions designed to increase activation and promote positive patient behavior.”4 Patients (and their caregivers) need to be active participants in the optimization of their own care, inclusive of changes in lifestyle, treatment (drug) adherence, condition monitoring, and intervention.

“Reduced costs.”

Consolidation among suppliers (manufacturers) and providers in areas of geographic concentration invariably results in higher prices.5 Despite supplier consolidation that may reduce internal sourcing, production and inventory costs, consumers may not be the beneficiary as competition is also reduced. Health insurance premiums are also higher in areas of insurer and/or provider concentration.6

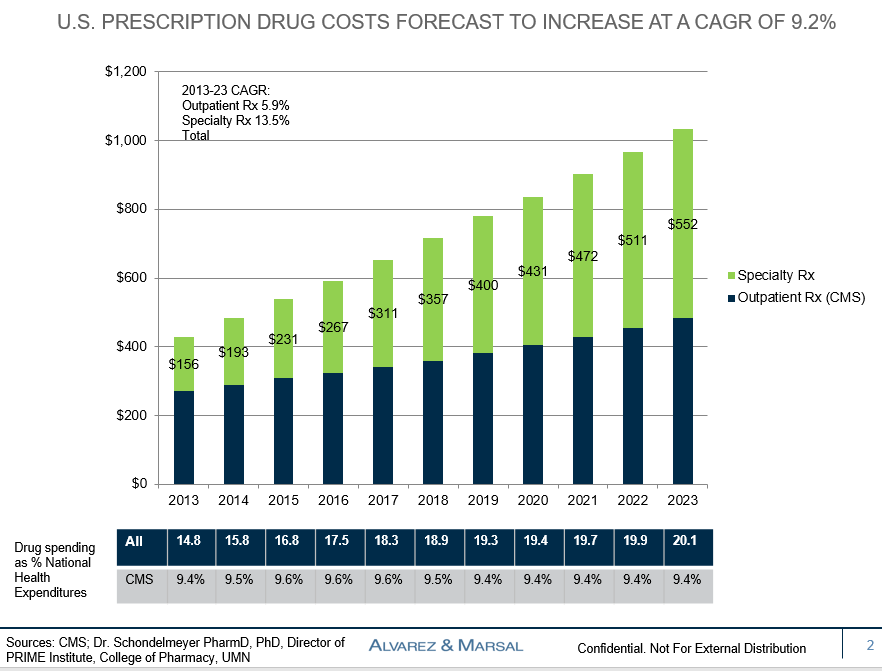

CVS has focused its growth strategy on consumer (retail), institutional (skilled nursing and assisted living facilities) and employer (PBMs) segments. Despite a generic drug penetration rate of greater than 89 percent (i.e., 11 percent of branded drugs have patents), the introduction of new drugs for cancer, hepatitis C and autoimmune conditions, combined with double digit price increases and major direct-to-consumer advertising campaigns have resulted in a dramatic rise in drug expenditures.7 Diabetes drug expenditures, alone, have increased from $22.3 billion in 2012 to $51.5 billion in 2016.8

The pharmacy benefit market is led by three companies: Express Scripts, CVS Health and Optum Rx with nearly a 75 percent market share, followed by Humana Pharmacy Solutions (10 percent), Prime Therapeutics (8 percent) and MedImpact (6 percent).9 The loss of Anthem, its largest client, by Express Scripts, and ongoing litigation creates a market share opportunity for CVS and other PBMs.

PBMs have had a controversial history given the lack of price transparency associated with drug volume rebates from the pharmaceutical industry. Current dynamics as illustrated by the acquisition of Aetna creates additional price opacity for employers (i.e., another point for shifting profits among various subsidiaries). Specialty pharmacy costs has been identified as the number one driver of rising large employer healthcare expenditures.10

“Improved access to health care.”

Patient access is defined as the attainment of timely and appropriate health care, and is increasingly recognized as an important determinant of quality, inclusive of experience. Rising out-of-pocket health care costs combined with increasing consumer demand for service excellence has created an opportunity, shifting market share among sites providing care.

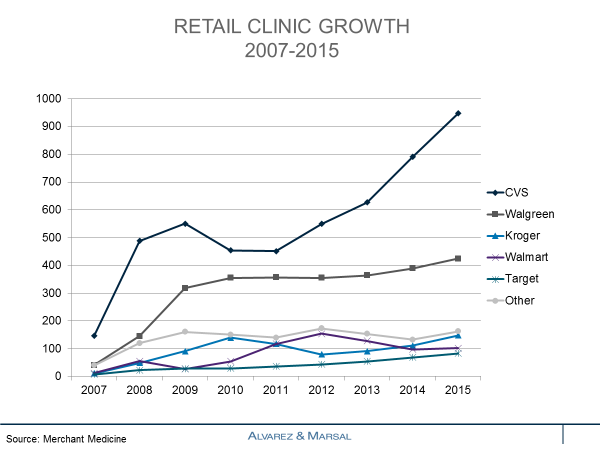

Hospitals, with comparatively expensive emergency and outpatient departments are most vulnerable. In 2014, there were 141 million Emergency Department (ED) visits of which 11.2 million or 7.9 percent resulted in hospital admissions.11 Semi-urgent, typically seen within 1-2 hours, and non-urgent cases seen in less than two hours, represent less than 40 percent of all ED visits.12 Many of the semi- and non-urgent visits are being made by Medicaid recipients without a primary care physician. Opportunities exist to redirect these patients to lower cost walk-in facilities such as CVS MinuteClinics and urgent care centers.

Opportunities also exist to increase the role of pharmacists in optimizing medication management and patient adherence.

Minor medical conditions and preventive activities make up the vast majority of retail clinic visits, such as upper respiratory tract infections (colds, flu, bronchitis, sinusitis), pharyngitis, immunizations, ear infections, urinary tract infections and conjunctivitis (pinkeye). Minor rashes, sprains and injuries make up the smaller balance of retail clinic visits.13 Ancillary offerings at retail clinics include throat swab (strep), urine and blood tests (e.g., cholesterol, glucose), and physical examinations inclusive of biometric screening for camp, sport activities and employment. Retail clinics are an attractive service component for national pharmacies and retailers as significant non-clinic revenues are generated to those businesses through prescription drugs, over-the-counter remedies and other products. MinuteClinics and other retail clinics have expanded their offerings to include chronic disease monitoring (e.g., hypertension, cholesterol, diabetes) and wellness services (e.g., weight loss, smoking cessation).

The growth of high deductible health plans, combined with the growing importance of convenience to consumers and the advent of telehealth, creates an opportunity for CVS to improve access.

Based on our analysis, the combination is not a new model of care delivery.

Healthcare delivery is centered on the provision of medical care by physicians and other types of providers, and not in the drug store, PBM and insurer operations. Opportunities do exist to improve the experience of care, improve medication adherence and other aspects of self-management. The rise in branded and specialty drug costs are not sustainable. The fundamental question will be the magnitude and amount of pass-through back to consumers if price moderation becomes a reality.

The CVS-Aetna combination is far different than the United Health Group’s (UNH) announced acquisition of Davita Medical Group (DMG) for $4.9 billion. DMG owns subsidiaries including Healthcare Partners and the Everett Clinic. Other provider-related acquisitions by UNH include New West Physicians in August 2017, Surgical Care Associates in January 2017 and MedExpress in April 2015.

1https://cvshealth.com/newsroom/press-releases/cvs-health-acquire-aetna-combination-provide-consumers-better-experience

2Drug Channels Institute. 2017 Economic Report on Pharmacies and Pharmacy Benefit Managers http://www.drugchannels.net/2017/02/the-top-15-us-pharmacies-of-2016.html

3Decline in Pharmacy Customer Satisfaction Driven by Prescription Drug Costs, J.D. Power Finds; September 5, 2017 http://www.jdpower.com/press-releases/jd-power-2017-us-pharmacy-study

4Patient Engagement in Healthcare: The Impact of the Patient Centric Model of Care. Liaison Technologies blog post, June 20, 2017 https://www.liaison.com/blog/2017/06/20/patient-engagement-healthcare-impact-patient-centric-model-care; Health Affairs RWJF Policy Brief; February 14, 2013

5Study: Healthcare consolidation leads to higher prices. MedCity News; June 13, 2016 https://medcitynews.com/2016/06/consolidation-hospital-prices/

6E. Bricker. Navigating Healthcare Blog. https://www.compassphs.com/blog/10-exclusive-facts-on-hospital-consolidation/

72017 Association for Accessible Medicine. Generic Drug Access & Savings in the U.S. https://accessiblemeds.org/sites/default/files/2017-07/2017-AAM-Access-Savings-Report-2017-web2.pdf

8Quintiles IMS Institute. Medicines Use and Spending in the U.S.; May 2017

9Pharmacy Benefit Management Institute https://www.pbmi.com/PBMI/Research/Industry_Research/PBMI/Research/PBMI___Industry_Research.aspx?hkey=22023612-80c4-4ada-a17e-85e7dfcbc1f8

10National Business Coalition of Health. https://www.cnbc.com/2016/08/11/expect-your-health-insurance-costs-to-rise-in-2017.html

11https://www.cdc.gov/nchs/fastats/emergency-department.htm

12CDC. National Hospital Ambulatory Medical Care Survey: 2009 Emergency Department Summary Tables

13http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2730172/