Build-to-Rent Tax Concessions: Bill Passes Both Houses

After much anticipation, the Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Bill 2024 (BTR Bill), which introduces the proposed Build-to-Rent Tax Concessions, finally passed both Houses on 29 November 2024 and received Royal Assent on 10 December 2024. The Senate introduced several important amendments that will directly affect BTR Owners. Learn how these legislative updates impact Build-to-Rent Owners and Developments.

Refresher: Proposed BTR Measures

As discussed in our articles dated 10 April 2024 and 11 June 2024, the Australian Government has proposed the following change for qualifying BTR developments (referred to as Active BTR Developments) from 1 July 2024:

- Managed Investment Trust (MIT) Withholding Tax: Reduction of the withholding tax rate from 30% to 15%.

- Capital Works Depreciation Deduction: Increase in the deduction rate from 2.5% to 4% per year.

These measures, collectively referred to as the Build-to-Rent Tax Concessions, aim to promote investment in the BTR sector.

Accompanying the BTR Bill is the Capital Works (Build to Rent Misuse Tax) Bill 2024 (BTR Misuse Tax Bill). This legislation introduces a BTR Misuse Tax designed to claw back tax benefits claimed by BTR owners if their developments cease to qualify as Active BTR Development during the 15-year compliance period. The BTR Misuse Tax is broadly equivalent to the tax benefit obtained under the Build-to Rent Tax Concessions, plus an interest component. Importantly, this tax is non-deductible.

Key Amendments to the Final Bills on Build-to-Rent Tax Concessions

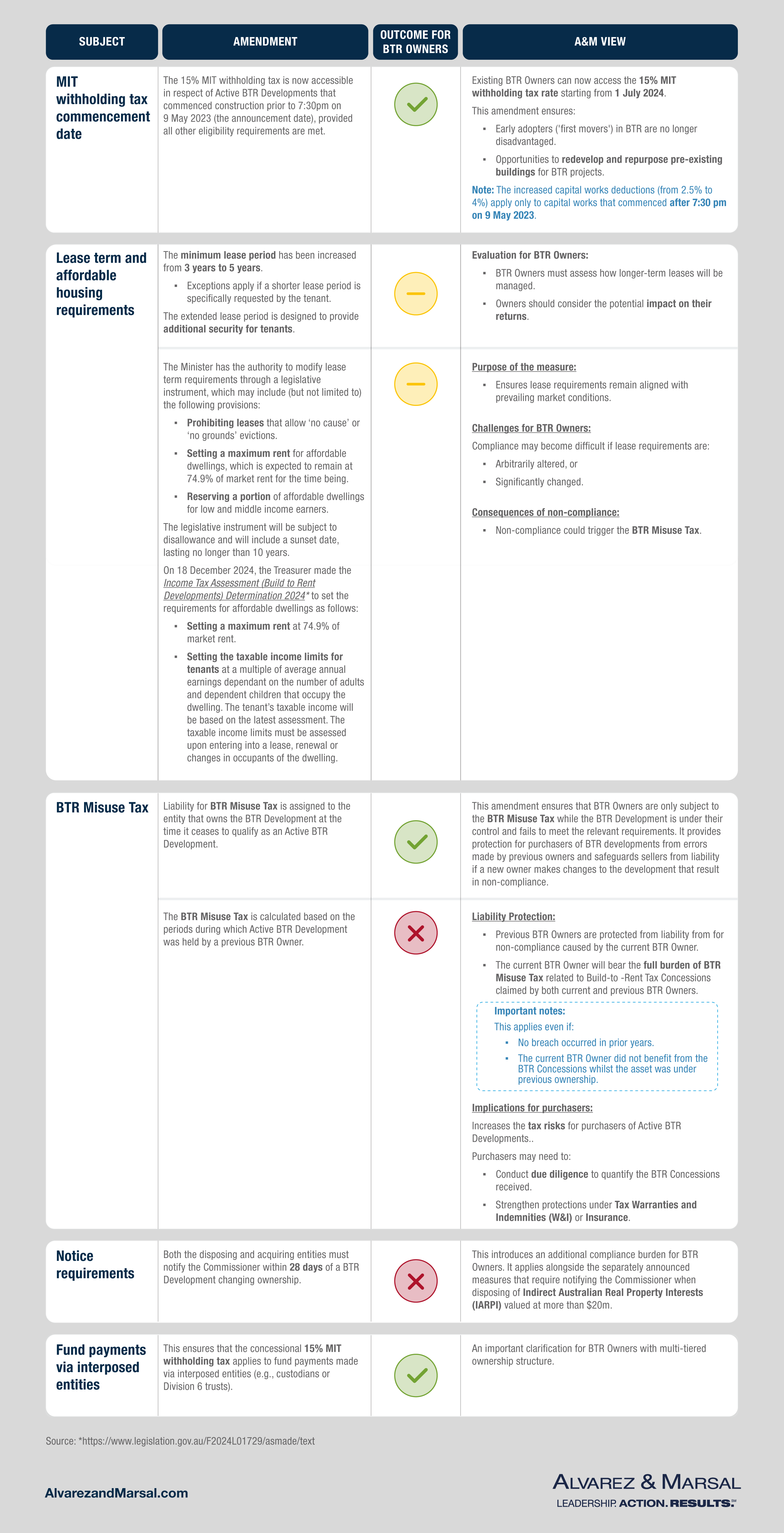

We have summarised the key amendments made by the Senate to the BTR Bill and BTR Misuse Tax Bill and provide our analysis below.

In addition to the BTR Misuse Tax, a General Interest Charge (GIC) may be imposed for late payments. Under a new Bill introduced to Parliament on 28 November 2024, any GIC incurred on or after 1 July 2025 will no longer be deductible. This bill has not yet been passed.

Final Comment on Build-to-Rent Tax Concessions

There are changes to the BTR Bill include some positive developments, particularly the ability to access concessional Build-to-Rent Tax Concession, such as the 15% MIT withholding tax for existing BTR Developments. However, the strict application of the BTR Misuse Tax and the potential for further lease requirements at the Minister’s discretion pose significant compliance challenges for both BTR Owners and BTR Managers. These challenges highlight the need for careful planning and adherence to the evolving Build-to-Rent Tax Concessions framework.