Alvarez & Marsal Releases UAE Banking Pulse For Q2 2021

- UAE banking sector’s profitability improves; Return on Equity (RoE) back at Q4 2019 levels

- Loans & Advances (L&A) increases as Dubai’s mortgage market witnesses strong rebound

- Asset quality set to stabilise reflecting a positive outlook for UAE banks

Dubai –– Leading global professional services firm Alvarez & Marsal (A&M) has released its latest UAE Banking Pulse for Q2 2021. The report highlights that the top ten UAE banks managed a healthy rebound in profitability and balance sheet metrics.

The RoE has reached its highest level of 10.9 percent for the first time in the last five quarters with 13.3 percent in Q4’19 as economic conditions continue to improve. An increase of +2.8 percent quarter over quarter (QoQ) in operating income coupled with lower impairment charges of-9.3 percent QoQ were the key drivers for growth in profitability.

The L&A increased by 1.9 percent QoQ, after declining for three consecutive quarters. Dubai’s mortgage market has indicated robust signs of improvement, with the number of mortgage issuances almost doubling between December 2020 and June 2021.

The asset quality of the UAE banks has stabilized overall after deteriorating in 2020. Three out of UAE’s top ten largest banks, including Emirates NBD, Mashreq and RAK Bank, have a coverage ratio of over 100 percent. The banks have shown that they are better positioned than before in managing stress in their balance sheets in view of higher capital buffers, improvement in recoveries and improving profitability. The lower provisioning by banks underlines an improved credit outlook for the sector.

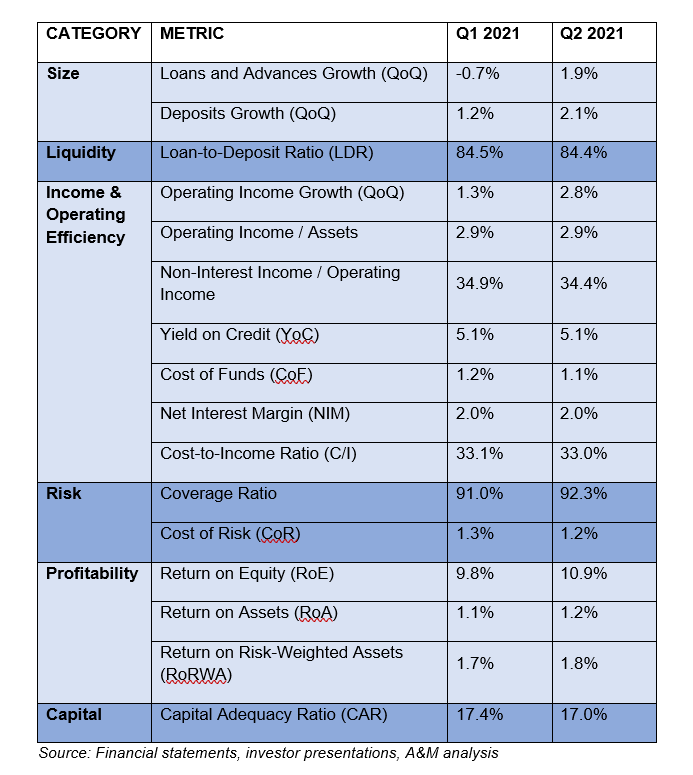

Co-authored by Asad Ahmed, Managing Director and Head of Middle East Financial Services, and Sumit Mittal, Senior Director at Alvarez & Marsal, the UAE Banking Pulse, examines the data of the 10 largest listed banks in the UAE, comparing the Q2’21 results against Q1’21 results. Using independently sourced published market data and 16 different metrics, the report assesses banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability and capital.

The country’s 10 largest listed banks analysed in A&M’s UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), National Bank of Fujairah (NBF), National Bank of Ras Al-Khaimah (RAK) and Sharjah Islamic Bank (SIB).

The prevailing trends identified for Q2 2021 are as follows:

1. L&A growth turned positive, while deposits further increased. The aggregate L&A for top ten UAE banks increased by 1.9 percent QoQ while the deposits increased by 2.1 percent QoQ. Deposit growth outpaced loans at most banks through the second fiscal quarter of 2021 as consumers and businesses cut spending amid economic uncertainty, bolstering already robust liquidity.

2. Operating income increased 2.8 percent QoQ, supported by reduced cost of funding and higher investment income. Major banks including FAB, and DIB reported substantial increase in their trading and foreign exchange income, which supported overall operating income.

3. Aggregate net interest margin (NIM) remained largely stable at 2.05 percent in Q2’21. NIM remained flat as industry-wide credit yields continued to remain suppressed while cost of funding declined marginally. While ADCB, CBD, and NBF reported NIM expansion by 10-20 bps, the remaining banks largely remained unchanged.

4. Cost-to-income (C/I) ratio remained largely unchanged at 33.0 percent, despite an increase in operating expenses of +2.5 percent QoQ. Among the top ten banks, FAB’s C/I ratio improved 2.1 percent points QoQ, as the bank deployed cost saving initiatives and generated synergies from Bank Audi Egypt’s integration. Seven of the top ten banks reported improvement in C/I ratio on a QoQ basis.

5. Aggregate asset quality (NPL / net loan ratio) appears to have stabilized after deteriorating for six consecutive quarters to reach 6.2 percent. Coverage ratio for the banks increased to 92.3 percent from 91.0 percent. The cost of risk decreased by ~13 bps QoQ, as total provisioning decreased ~9.3 percent to AED 4.8bn. The lower provisioning by the banks reflects an improving credit outlook on the back of an improving economic situation.

6. RoE rebounded to reach to double-digit levels of 10.9 percent from 9.8 percent. Total net income increased by 11.5 percent QoQ, primarily due to significant decline in impairment allowances of -9.3 percent QoQ and rise in net interest income by 3.5 percent QoQ. Consequently, profitability metrics such as RoE at 10.9 percent and return on asset (RoA) at 1.2 percent have improved. ENBD with 12.5 percent and CBD with 13.3 percent reported the highest RoE among the top ten banks.

OVERVIEW

The table below sets out the key metrics:

Mr. Ahmed commented: “Improvements in asset quality are helping to drive the UAE banking sector turn around. We look forward to this trend continuing. The UAE’s Central Bank’s Q2’21 credit sentiment survey notes a strong, ongoing domestic credit demand across all sectors of the economy indicating that a vibrant recovery is on track. However, the U.S. Fed’s commitment to maintaining the current low level of interest rates is expected to keep domestic banks’ income streams under pressure. We believe focusing on significant efficiency improvements, continuing to adopt technology, either organic or in partnership with fintech’s, and actively managing non-performing portfolios are critical to driving improvements forward.”

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 5,000 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter, and Facebook.

# # #

CONTACT:

Kiran Makhija/ Prerna Agarwal, +971 55 471 0294/ +971 52 787 3189

Hanover Middle East

Sandra Sokoloff, Senior Director of Global Public Relations

Alvarez & Marsal, +1 212-763-9853