A&M’S 2025 Cybersecurity Market Study

The Ongoing Battle: Balancing Cybersecurity Risks and Budgets

Cybersecurity teams are continuously challenged by emerging threats, including a significant rise in cyberattacks, ransomware, and novel threats leveraging artificial intelligence (AI). The cybersecurity landscape continues to evolve to counter these risks while customers navigate changing needs and seek to balance trade-offs between budgets and security posture.

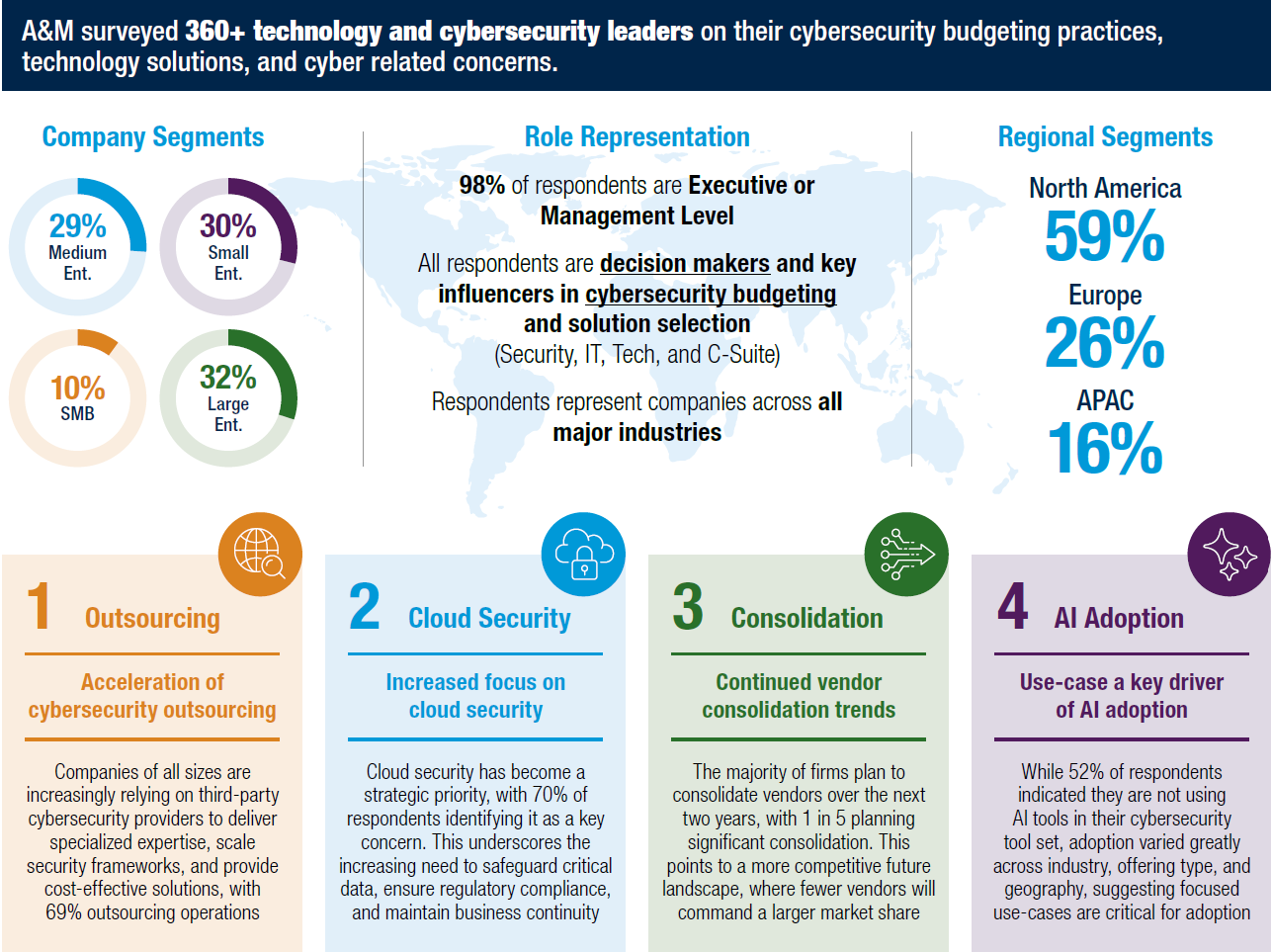

Based on responses from more than 360 technology and cybersecurity leaders, Alvarez & Marsal’s annual Cybersecurity Market Study explores how cybersecurity companies are facing an increasingly competitive marketplace with a key focus on trends involving outsourcing, cloud security, vendor consolidation, and AI. These factors suggest cybersecurity technology providers will need to optimize their product portfolios and realign research and development investments for more targeted use cases.

Key Findings

69%

of respondents outsource cybersecurity operations (up from 61% last year).

66%

of respondents increased outsourcing budgets year over year.

99%

of respondents increased or maintained cloud security budgets.

70%

of respondents cite cloud security as a key concern.

57%

of respondents plan for vendor consolidation in next two years.

48%

of respondents indicated they are using AI tools in their cybersecurity tool set.

56%

of respondents reportedly want to see more AI functionality in their cybersecurity framework.

65%

of respondents did not want to see more investment in AI.

Business leaders tasked with overseeing cybersecurity are increasingly leaning on their external partners to deliver specialized expertise, scale security frameworks, and provide cost-effective solutions.

69% outsource cybersecurity operations (up from 61% last year)

66% increased outsourcing budgets year over year

Cloud security is now a top outsourced area

As cloud adoption grows and bad actors target the cloud environment, cloud security has become a strategic priority and is one of the primary drivers of incremental cybersecurity spend.

Respondents note that cloud security budgets were increasing or remaining the same in 99% of cases

70% identify cloud security as a key concern

Buyers want cloud-native controls that easily integrate across hybrid and multi-cloud environments

Organizations are streamlining their security stacks to reduce complexity and costs, while improving oversight and control.

57% of respondents plan to consolidate vendors in the next two years, with about one in five planning significant consolidation

Price has risen as a key purchasing criterion, up 5x in importance from last year's survey

Findings indicate a more competitive future landscape with fewer vendors expected to command a larger market share

Leaders want targeted, reliable AI use cases that address existing pain points.

48% are currently using AI in their cybersecurity tool set; among users, 65% increased usage year-over-year

Respondents were most interested in fraud detection, real-time threat detection, and network security, indicating confidence in AI's ability to detect anomalies

- Integration and reliability concerns were the primary barriers to adoption

To remain competitive in the market, cybersecurity providers must navigate the needs of their clients and differentiate themselves through their pricing, AI offerings, and cloud services, keeping in mind the following:

- Position Services Competitively

- Provide Cost and Scalability Benefits

- Drive AI Adoption