Transfer Pricing

International regulations state that transactions between subsidiaries should be conducted as though the parties are entirely independent. A&M helps multinational companies across sectors navigate this complexity while preserving business value.

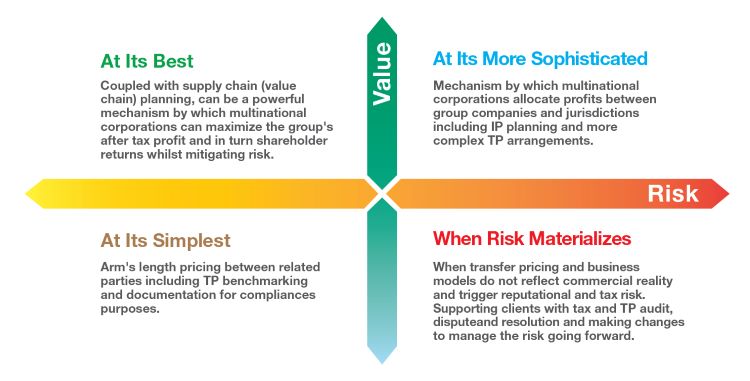

Transfer pricing can aid organizations with everyday compliance and benchmarking right through to strategic initiatives affecting business operations, risk management and supply chain planning.

The service in depth

All transfer pricing engagements are carried out on a bespoke basis that acknowledges each client’s unique circumstances. The beginning of a client partnership starts with a highly cost-efficient review of risks and opportunities that identify areas of focus for the longer term.

A&M’s transfer pricing service evolves in line with clients’ broader corporate goals. This includes designing transfer pricing strategies in line with international regulatory standards. Adhering to the internationally recognized ‘arm’s length principle’, A&M helps companies understand the consequences of profit allocation decisions and execute compliant transfer pricing strategies that preserve value.

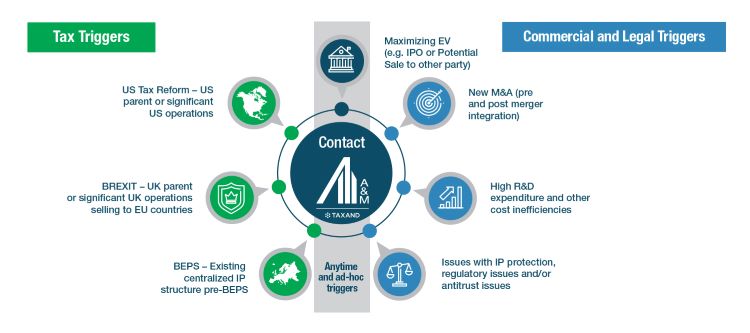

A&M’s service is designed to respond to the new business challenges clients face. A&M can create robust transfer pricing policies for businesses expanding into new markets, for instance. A strategic transfer pricing protocol can also add value for companies carrying out M&A activity, whether at the due diligence phase or in post-merger integration.

Why A&M?

Although well-executed transfer pricing strategies can add significant value to companies, in-house tax and finance teams do not always possess intimate transfer pricing knowledge. A&M’s professionals help fill these knowledge gaps within the organization.

With team members hailing from around the world and experience working on almost every continent, A&M’s hands-on senior professionals understand the complexities of establishing tax arrangements across multiple jurisdictions. Freedom from audit conflicts mean A&M’s transfer pricing clients can benefit from operational, strategic and legal expertise from other practice areas.

Learn more:

| Transfer Pricing Solutions | Contact Us |

Key Contacts:

Harpreet Dosanjh, Senior Director

hdosanjh@alvarezandmarsal.com

Charles Waite, Senior Director

cwaite@alvarezandmarsal.com

Rasmus Steiness, Senior Director

rsteiness@alvarezandmarsal.com