Tax Risk and Dispute Management Services

For an immediate, confidential conversation, please call +44 161 518 1089.

Alvarez and Marsal’s Tax Risk & Dispute Management specialists provide proactive tax risk management advice alongside expert tax dispute resolution services. This combined approach allows us to support our clients with all levels of their tax governance and HMRC interactions.

We work closely with our multi-discipline tax specialists to provide expert advice across all taxes. Our approach is tailored to the unique needs of each client, from individual taxpayers right through to large multinational corporates, across all sectors.

Why Choose A&M’s Tax Risk Management Services?

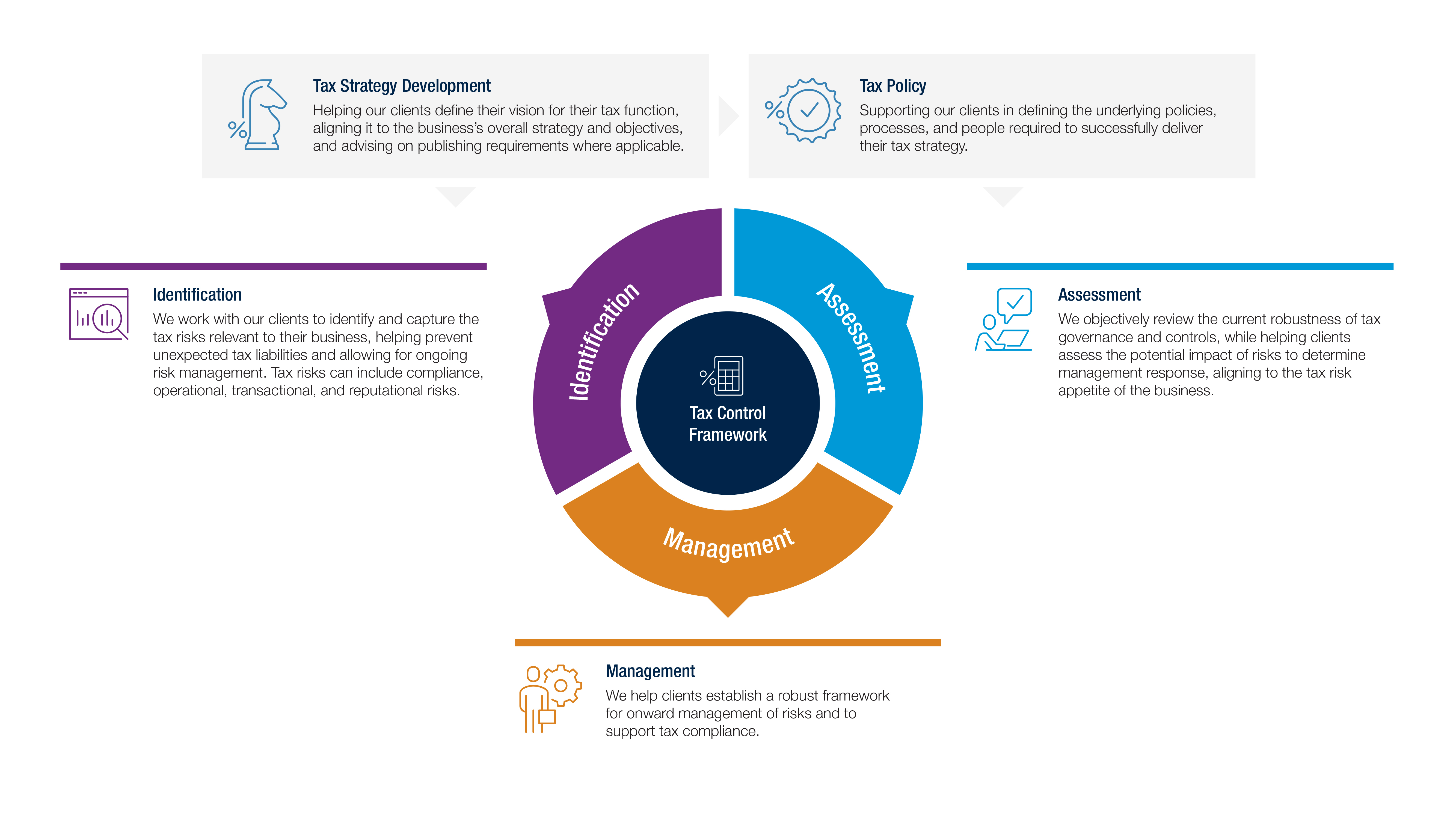

With ever emerging tax legislation, regulation and HMRC scrutiny, businesses of all sizes should be considering and strengthening their tax control framework in their efforts to attain tax certainty. Good tax governance and a robust Tax Control Framework not only mitigates the risk of future tax disputes but also creates the opportunity for tax functions to link into businesses’ wider operations and objectives, potentially improving budgets and resources.

At A&M, we work with businesses to proactively identify, assess and manage their tax risks with the aim of mitigating exposure to HMRC challenge and unexpected tax obligations. We provide a comprehensive and tailored approach to all aspects of tax governance and risk management.

Our Tax Risk Management Services Include:

- Tax strategy development and publishing

- Tax policy development

- Tax risk register/control matrix development

- Tax audits

- Senior Accounting Officer reporting assistance

- Business risk review support

- Tax operations assessments

- Tax accountability matrices

- Corporate Criminal Offences for not preventing the facilitation of tax evasion (Criminal Finances Act 2017) defence development

- Transaction Related Tax Assurance

Why Choose A&M’s Tax Dispute Management Services?

HMRC is committed to tackling tax avoidance and evasion, with investment being made into increasing the number and training of inspectors working in this area, as well as greater use of AI and data analytics in identifying potential issues.

Dealing with an HMRC enquiry can be time-consuming, frustrating and stressful, and should be handled with the utmost care to achieve the best possible results and avoid potential pitfalls.

A&M has a wealth of experience in helping our clients to settle tax disputes of all kinds efficiently and effectively, utilising our knowledge and understanding of HMRC enquiry policies, processes and penalty regimes. We will also happily work alongside existing accountants and advisors, ensuring these relationships can be continued moving forwards.

Whether an HMRC-instigated enquiry or voluntary disclosure, we help our clients determine the best settlement route for their individual circumstances, and manage the HMRC relationship to provide a buffer and allow our clients to focus on their daily business in the knowledge that their tax issues are being handled expertly. Typically, we achieve lower tax bills and penalties through understanding and presenting the context and facts of the case in a collaborative manner with HMRC, allowing for a better future relationship with the tax authorities.

Our Dispute Resolution Services Include:

- All HMRC enquiries and voluntary disclosures (personal, corporate, partnership, trusts, etc)

- Code of Practice 8 and 9 enquiries

- Nudge letter responses

- Cross tax enquiries

- Avoidance cases

- Alternative dispute resolution (tax mediation)

- Time to pay arrangements