FUND STRUCTURING AND FUND TAX COMPLIANCE

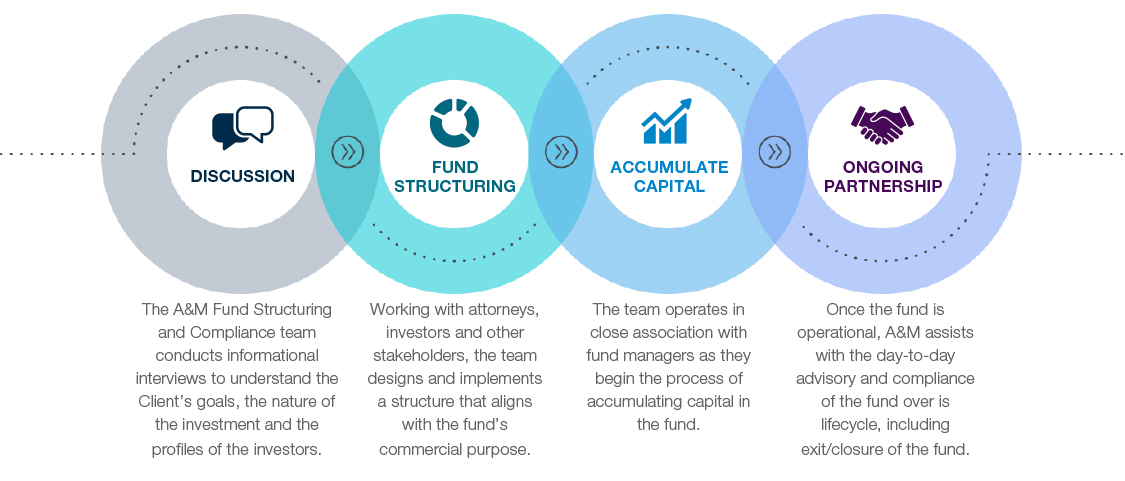

A&M’s Fund Structuring and Fund Tax Compliance team provides tax advisory and compliance services relating to the pooling of capital . The team excels at assisting with the design of a fund, having regard to the investment mandate and the profile of investors. We plan for and preserve the flowthrough tax treatment of the fund, and on a day-to-day basis, we provide clients with the confidence that all lodgements are accurately completed to keep the fund compliant.

WHY OUR CLIENTS CHOOSE US

Trust and expertise

A&M’s Fund Structuring and Tax Compliance team provides a level of confidence for our Clients because of our deep technical expertise and specialism in this complex area of Australian tax law.

Agility

A&M’s bias to action and breadth of talent means we can be flexible to meet Clients’ needs at any given time. We are unencumbered by some of the overhead and structures of some advisors, leading to more value for our Clients.

Independence

A&M is not an auditing firm, giving us the freedom to provide a full range of tax services and to manage key interdependencies across all a fund manager’s needs.

Bespoke technology

The team has created and leverages bespoke digital tools to analyse fund structures and investor profiles, which minimises risk and helps to ensure funds are structured both optimally and to meet regulatory requirements.

THE A&M TAX APPROACH

THE A&M DIFFERENCE

CERTAINTY

A&M ensures that the structure is viable so Clients can be certain all material tax considerations have been accounted for.

SECURITY

With the heightened regulatory scrutiny in recent years, we ensure Clients are prepared for potential inquiries or audit investigation.

CLOSING THE LOOP

There is often a disconnect between the advice the fund manager first receives about the fund when they make investment decisions and the compliance requirements at year end. A&M seamlessly integrates transactional and structuring advice with on-going reporting obligations, closing the loop between the advisory and compliance workstreams.

TOP FUND TAX EXPERTISE

Only a handful of advisors in Australia specialise in fund structuring and compliance. The A&M difference delivers a team that is not comprised of generalists, but rather specialists who advise on fund structuring every day, often serving as an extension of the in-house attorneys who document the fund design.

Learn more about our Fund Structuring and Fund Tax Compliance Services