Tax Performance Improvement Services

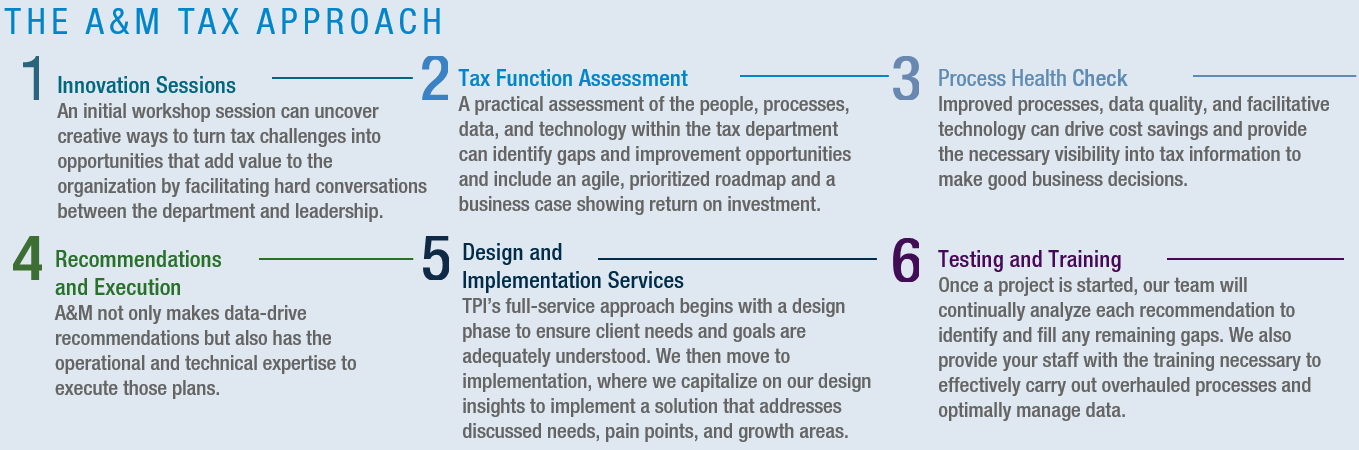

A&M’s Tax Performance Improvement (TPI) team helps companies and C-suite leaders meet their strategic goals by transforming teams, processes, data, and technology. These initiatives improve resource allocation toward value-added activities, reduce reliance on external providers, lower costs, and strengthen talent retention. By launching with our Innovation Session approach, your company’s stakeholders shape tailored solutions that directly address pain points and reduce risk. This collaborative process enhances C-suite visibility into tax operations while equipping tax departments with the tools to deliver measurable value more efficiently and effectively.

WHO WE HELP

- Mid to large multinationals

- Organizations with change in leadership or talent pool

- Companies with M&A, carve-outs, IPOs, and/or need to enhance controls

- Corporations that have increased in size or complexity quickly

TAX PERFORMANCE IMPROVEMENT | OUR SERVICES

■ Tax strategy labs

■ Risk framework development

■ Department stand-up and design

■ Performance management

■ Business collaborations

■ Global service center setup

■ Succession planning and tax leadership programs

■ Process reengineering

■ Curated innovation sessions

■ Organization realignment

■ Benchmarking

■ Strategic visioning

■ KPI development

■ Roadmap and business case

■ Digital enablement

■ Vendor selection

■ Tool recommendations and alignment

■ Tax system design and implementation

■ Control testing/compliance and remediation

■ Training on enabling technologies

■ Tax provision enhancements

■ FP&A and quarterly projections

■ C-suite and board reporting packages and recommendations

■ Pillar 2 process and reporting

■ Scenario modeling

■ Reporting and analytics

■ Data cleansing

■ Predictive analytics

■ Robotics and AI

■ Financial and tax forecasting

■ ERP and financial systems readiness (including Pillar 2)

WHY OUR CLIENTS CHOOSE US

- Cost Takeout and Pay For Model: Organizations improve liquidity and reduce costs by leveraging tax technology to streamline compliance, automate workflows, and reduce dependency on external advisors. Our solutions are designed not only to drive operational efficiency, but also to build the analytical tools and data infrastructure needed to proactively mitigate tax liabilities—maximizing after-tax cash flow and aligning tax strategy with business performance. Often the savings realized can pay for our services and/or offset transformation costs across the organization.

- Combination of Technology and Tax Technical Skills: Few advisors bring our depth of experience and expertise in process and technology augmentation paired with tax technical and corporate tax leadership experience.

- Our teams have stood in the shoes of our clients, as most of us have a mix of both industry and tax consulting backgrounds: Our close relationship with A&M’s CFO Services and industry specialists further ensures clients will have the right multidisciplinary team for their needs.

- Global Capability Centers (GCCs) as a Scalable Model: We help tax departments leverage GCCs to centralize repeatable functions, reduce costs, and improve process control—freeing local teams to focus on strategy and planning. Clients can also tap into our firm’s established GCC as a flexible service model to accelerate execution, enhance scalability, and maintain high-quality outcomes without building new infrastructure.

COMMON INITIATIVES INCLUDE:

- Efficiency, cost take out and tax optimization

- ERP/EPM and data enablement

- Provision design and software implementation

- Internal controls and risk mitigation

- Change management and Pillar 2 readiness / implementations

THE A&M DIFFERENCE

- Focus on Cost Reduction and Liquidity. By modernizing tax operations through technology, we help organizations unlock cash, lower operating costs, and enhance internal capabilities. Our approach enables in-house teams to identify planning opportunities, limit tax exposure, and align tax outcomes with broader financial goals.

- Integrated Tax Solutions Backed by Enterprise-wide Expertise. A&M’s integration with broader Corporate Performance Improvement (CPI), transaction advisory, and CFO services practices allows clients to benefit from cross-functional insight—bridging tax with finance, operations, and transformation initiatives.

- Mitigate Risk and Optimize Data. A highly functioning tax department—with optimal data management and efficient processes—can reduce the risk of errors and enhance the reporting and planning capabilities. Once tax has a seat at the table for major business decisions, your company can better capture tax savings and planning opportunities.

- Provide an Independent Evaluation. A&M’s TPI team is solely focused on improvements that add value to the company and is platform- agnostic when making recommendations or executing action plans. We do not push co-sourcing or recommend outsourcing of the tax department for our clients, but instead focus on working with your team to provide practical solutions, which we work hand-and-hand with your team to implement.