At Alvarez & Marsal, we believe in helping companies create and execute successful decarbonization strategies that position them for financial, reputational, and market advantage. Our carbon reduction approach is designed to harmonize business and operational performance by developing an integrated approach that can be executed on the ground. This enables companies to benefit from operational efficiency improvements, robust capital allocation, and accelerated innovation. As the pressures for carbon reduction continue to rise due to evolving regulations, customer and investor expectations, and the need to differentiate, now is the time to stand out with our Decarbonization & Climate Risk Services.

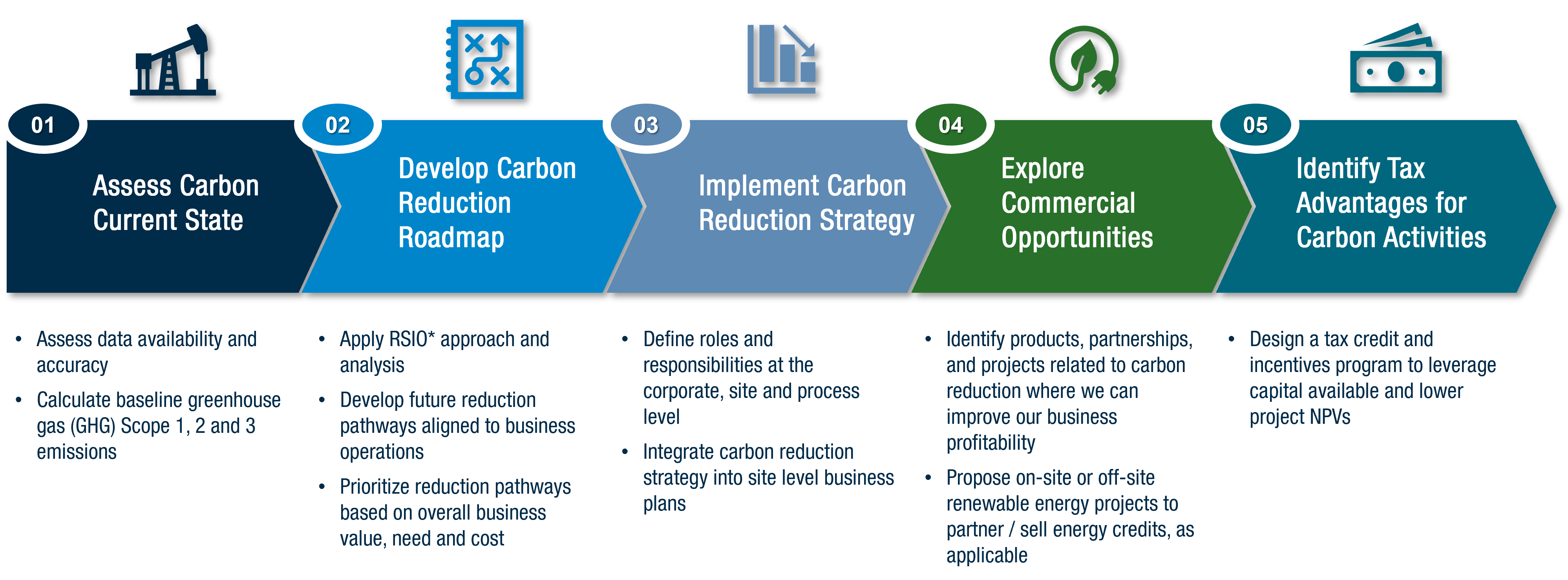

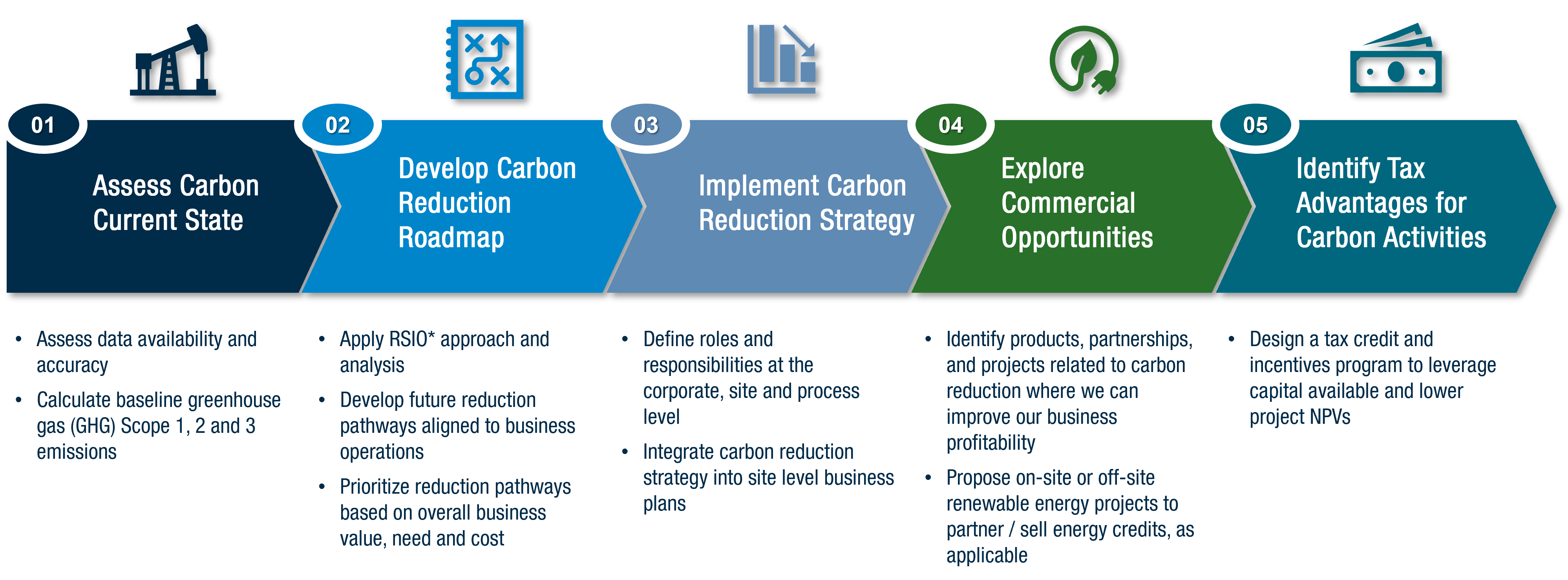

Our Differentiated Playbook to Decarbonization

A&M seeks to understand the total impact and value to the business when identifying and prioritizing carbon reduction opportunities. Our goal is to quickly define and implement a strategy which prioritizes quick wins to fuel longer-term decarbonization opportunities.

Achieving Carbon Reduction to Drive Tangible Business Value

Improved Operational Efficiency

Our climate solutions are designed to help you reduce emissions and drive increased operational efficiency. With our solutions, you will reduce energy consumption, optimize production cycles, and lower maintenance costs and operational downtime.

Robust Capital Allocation

Our climate solutions allow you to make informed investment decisions with accurate internal rate of return (IRR) calculations. With our solutions, you will be able to incorporate carbon pricing and offsets into your capital decisions, helping you ensure that future carbon costs don’t impact the net present value.

Rewards from Innovation

Our climate solutions provide you with access to tax credits and incentives, enabling you to view emissions reduction efforts as value drivers. With annual climate spending in the United States is projected to grow to $80 billion over the next ten years[1], our offerings can help you reap the rewards of this investment for your organization.

Unique Commercial Partnerships

Our climate solutions include proactive utility investments and renewable energy partnerships, to reduce procurement costs and emissions simultaneously. Our solutions can also help you tap into the predicted global GDP growth of a large-scale decarbonization effort, estimated to be $43 trillion[2].

[1] Source: https://rmi.org/climate-innovation-investment-and-industrial-policy

[2] Source: https://rmi.org/climate-innovation-investment-and-industrial-policy