e-Invoicing in Malaysia

Malaysia is set to embrace e-Invoicing as part of the digital transformation of its tax regime, with a phased rollout starting in August 2024 for taxpayers with revenue over 100 million MYR per year. By July 2025, the Inland Revenue Board of Malaysia (IRBM) has stated that all taxpayers will be required to issue e-Invoices, making it essential for every business to understand and comply with the new process.

This initiative requires the sending and receiving of invoices using an electronic format, revolutionizing the traditional invoicing process with the aim of improving efficiency and reducing errors, whilst also curbing cases of fraud and potential tax evasion.

Read on to find out more about the key steps in the e-Invoicing process, as well as the benefits and how A&M can assist you.

Key Steps in Malaysia’s e-Invoicing Process

Malaysia’s e-Invoicing process can be summarized in six key process steps:

1. Issuance of e-Invoice – When a sale or transaction is made, the supplier creates an e-Invoice and shares it to the IRBM using either the MyInvois Portal or API for validation.

2. Validation of e-Invoice – Validation by the IRBM will be performed in near real-time, with valid e-Invoices receiving a Unique Identifier Number from the IRBM.

3. Notification of valid e-Invoice – The IRBM will inform both the supplier and buyer once the e-Invoice has been validated (via either the MyInvois Portal or APIs).

4. Sharing of e-Invoice – Upon validation, the supplier is obliged to share the e-Invoice with the buyer.

5. Rejection or cancellation of e-Invoice – A stipulated period is given to request rejection (Buyer) or cancellation (Supplier)

6. MyInvois Portal – Supplier and buyer will be able to obtain an e-Invoice summary from the Portal.

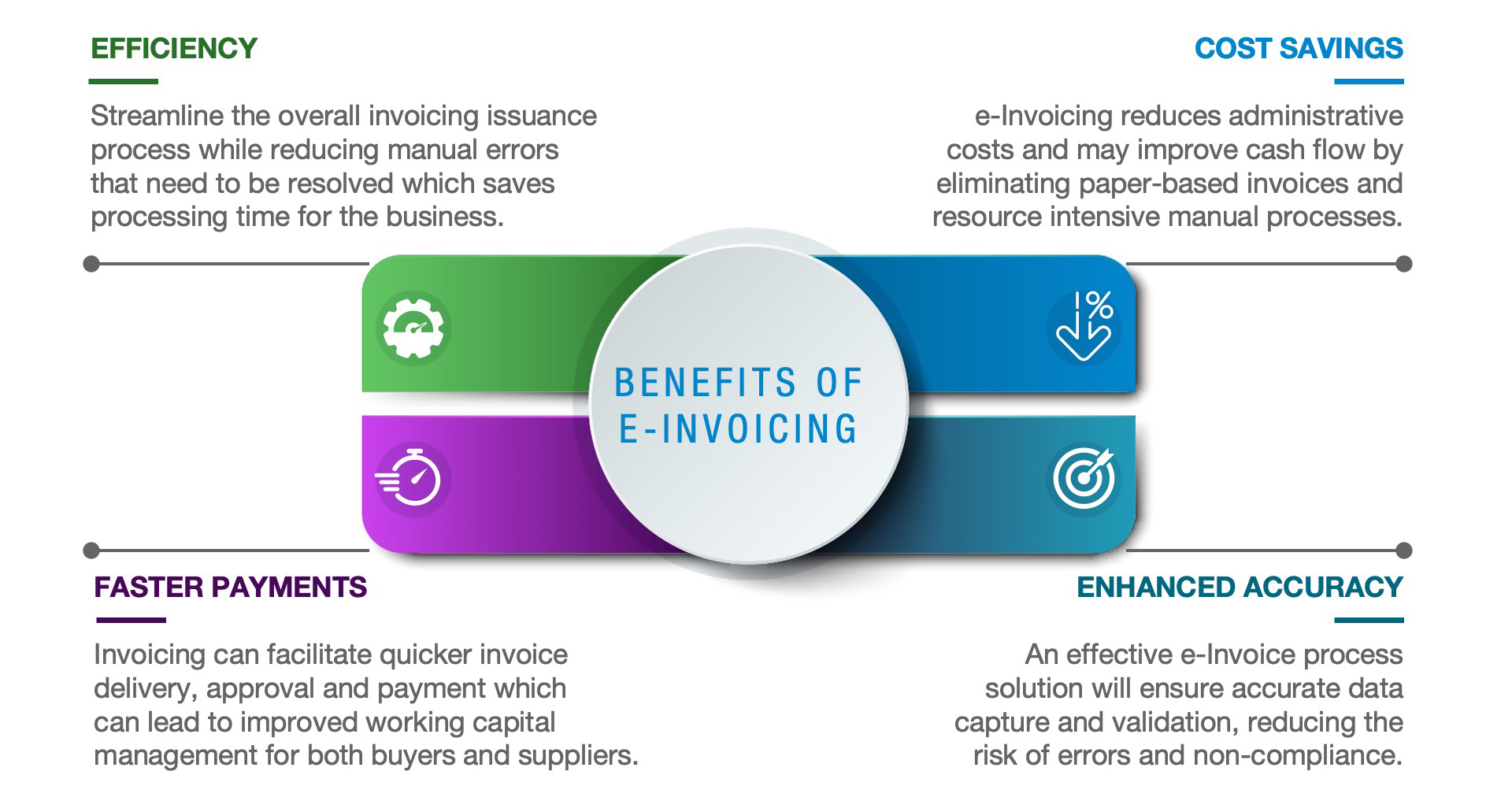

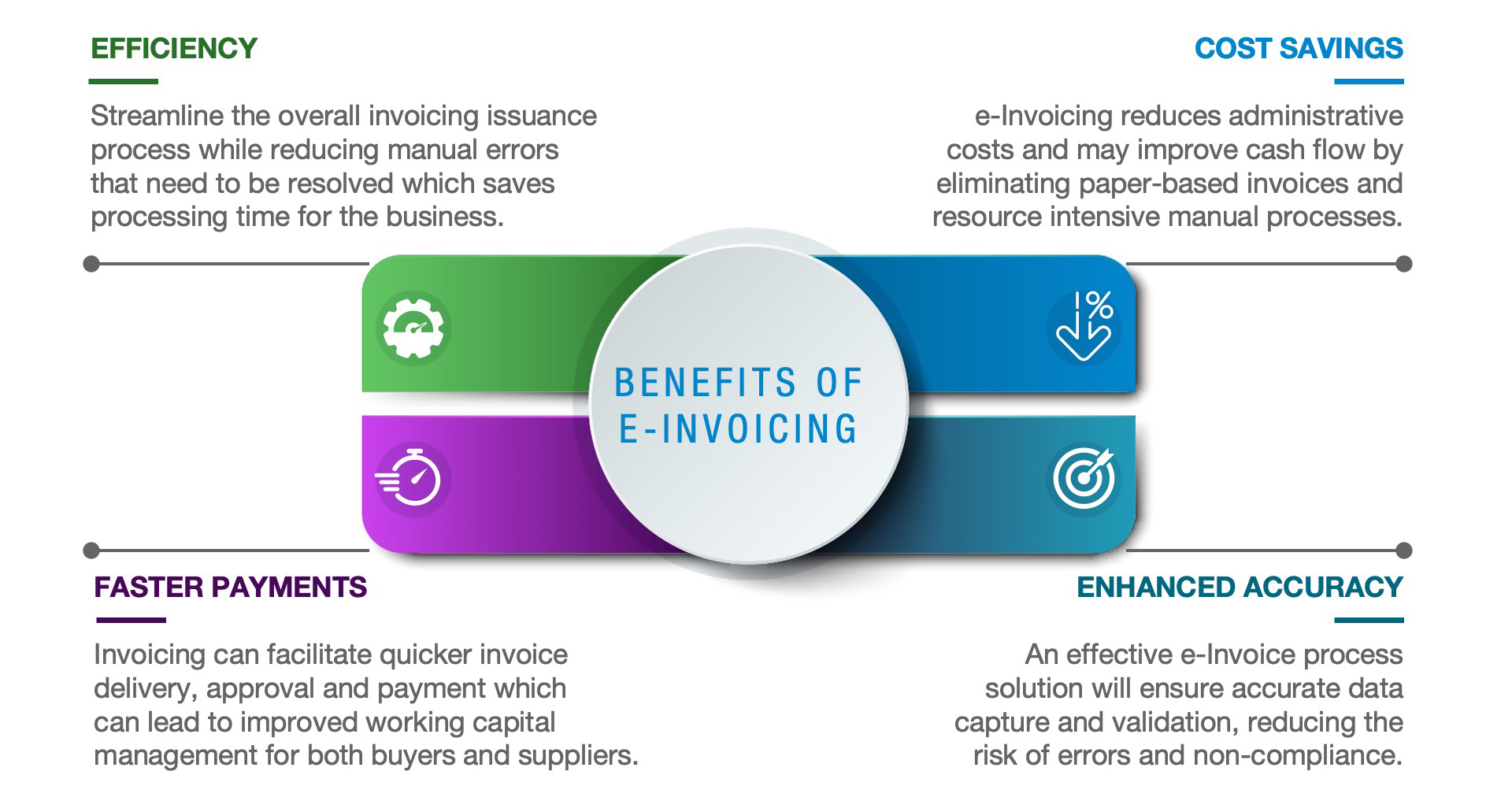

What are the benefits of e-Invoicing?

The benefits of e-Invoicing in Malaysia will go beyond tax compliance function. Based on our experience, implementing an e-Invoicing solution has several advantages:

With the new e-invoicing process beginning its phased roll out in August 2024, the time to act is now to ensure you are ahead of the curve and set up for success.

Below are the ways A&M can assist you:

- Using our network of Trusted Partners, A&M can support the vendor selection process, helping you choose a solution provider with market experience and industry expertise.

- We will help to identify the right technological solution for the right tax and business circumstances.

- We will take into account the ERP systems you currently use, other markets already live with e-Invoicing, and connectivity with other IT technology.

A&M can bridge the gap between technology and tax expertise:

- We ensure key IT stakeholders are engaged for optimal results.

- We help you understand the interaction between e-Invoicing requirements, e-Invoicing solutions and underlying ERP systems.

- We will define systems and data requirements upfront to avoid delays in implementation.

Using our global experience, A&M can support stakeholders with training and ad-hoc advisory. Specifically, we can help:

- Provide E-Invoicing support, including post-implementation optimization and improvements.

- Train users both before and after solution implementation.

- Provide the necessary support to drive change in your business to ensure success.