POST DEAL IMPLEMENTATION TAX SERVICES

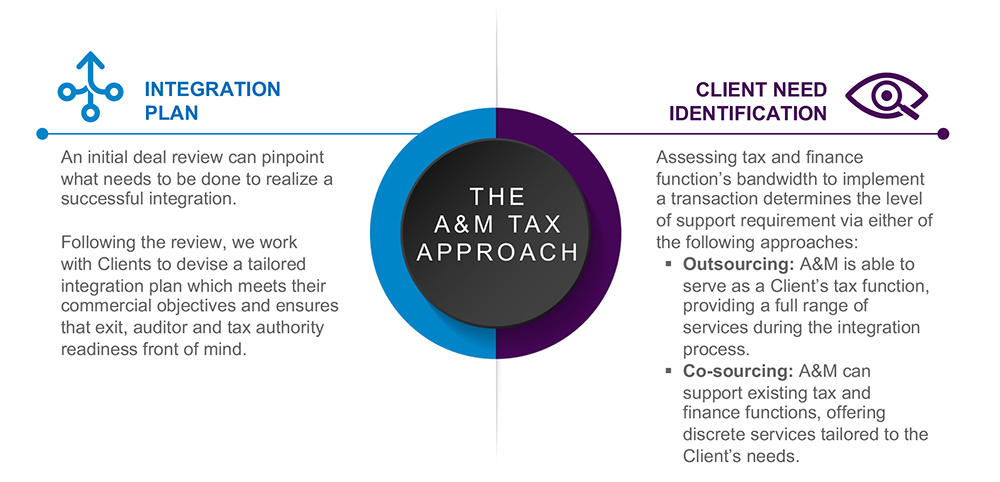

A&M’s Post Deal Implementation Tax Services team supports tax and finance functions as they implement new transactions, from the signing of a deal and continuously through the 12 months or more following a purchase. The Team’s deep understanding of deal structures and key attributes allows us to ensure no money is left on the table after a transaction, and that transaction risks are appropriately managed. Our services include assistance with cash tax savings, attribute transfers, tax purchase price accounting, due diligence remediation, regulator notifications, post deal compliance and all other integration matters. We can act as your tax function during the integration period or simply supplement your team by leveraging our expertise to assist with discrete integration matters.

WHY OUR CLIENTS CHOOSE US

Senior-led team

A&M’s engagements are all directly led by senior leadership who are actively involved in the day-to-day delivery on projects. Through their hands-on approach, they provide clients industry experience and deliver operational and strategic solutions and resources.

Expertise

We offer market leading experience on tax integration matters. The integration team is “M&A trained” which allows us to understand transaction complexities and provide services that meet Clients’ governance and risk profiles.

Independence

A&M is not an audit firm, giving us the freedom to provide a full range of tax (and non-tax) services and manage key interdependencies of the finance function across deals.

THE A&M DIFFERENCE

VALUE CREATION AND SAVINGS

Identifying and capturing all tax attributes, preventing cash from being left on the table.

INTEGRATION GOVERNANCE

Off the back of a deal, the tax and finance functions have much to implement and are often resource constrained. A&Ms post deal implementation plans help create the frameworks and governance to manage integration. These functions can ensure that risk is managed and value is captured.

OPERATIONAL WORK

A&M’s Post Deal Implementation Tax teams provide hands-on integration management, helping to run tax functions for the first 12 months (or more) after a deal

VALUE PRESERVATION/ REVIEW READINESS

Manage tax exposures to prevent future price adjustments and review findings, helping preserve valuations during a sale process and obtain positive outcomes during audits or ATO reviews