Time to act —How banks should comply with Article 21c CRD VI

As CRD VI introduces sweeping changes for third-country banking groups in Europe, one question remains: Why is regulatory guidance on Article 21c CRD VI still so vague?

This provision—a cornerstone of CRD VI—redefines how non-EU banks can operate in the EU by imposing strict requirements for local presence, yet key details around its implementation remain unclear.

What is Article 21c CRD VI and why it matters

The EU's Capital Requirements Directive VI (CRD VI) Article 21c establishes new operational rules for third-country banking groups operating in the European Economic Area. Core banking services such as lending and deposit-taking, together with guarantees and payment services, will become available exclusively through EU-authorised branches or subsidiaries beginning early 2027. Many third-country groups that operate from non-EU financial centres face an important market change, since they will lose their ability to serve EU customers through remote operations.

Key regulatory changes under CRD VI

The implementation of CRD VI introduces a set of structural requirements that reshape how third-country banking groups operate in the EU. These include:

- Subsidiarisation: Third-country groups with two or more EU subsidiaries will be required to establish an EU Intermediate Parent Undertaking (IPU).

- Booking model: New booking requirements will apply to Third-Country Branches (TCBs) operating in the EU, shifting transaction processing and oversight obligations.

- Licensing requirement: Firms will need to clarify their booking models to ensure supervisory transparency across jurisdictions.

- Capital, liquidity and risk management: Authorised branches will be subject to stricter capital, liquidity, governance and risk oversight standards.

Limited guidance, compressed timelines

The new regulatory requirement has created an immediate sense of pressure among market participants who seek detailed implementation guidelines. The regulatory technical standards needed to define fundamental aspects of Article 21c CRD VI will not become available until 2026, which gives institutions a short window to make necessary adjustments. These institutions face an uncertain period because they need to make important decisions without clear operational guidelines. The gap between regulatory mandates and insufficient guidance has sparked escalating market-wide worries.

Moreover, regulators have reinforced this intent through Recitals and Explanatory Memoranda accompanying CRD VI, which stress the need for “substance.” This means shell entities or letterbox operations will not be sufficient. Institutions will be required to demonstrate that their EU entity operations reflect the nature, risk, and volume of their EU-facing activities.

Implementation timeline and strategic pressure points

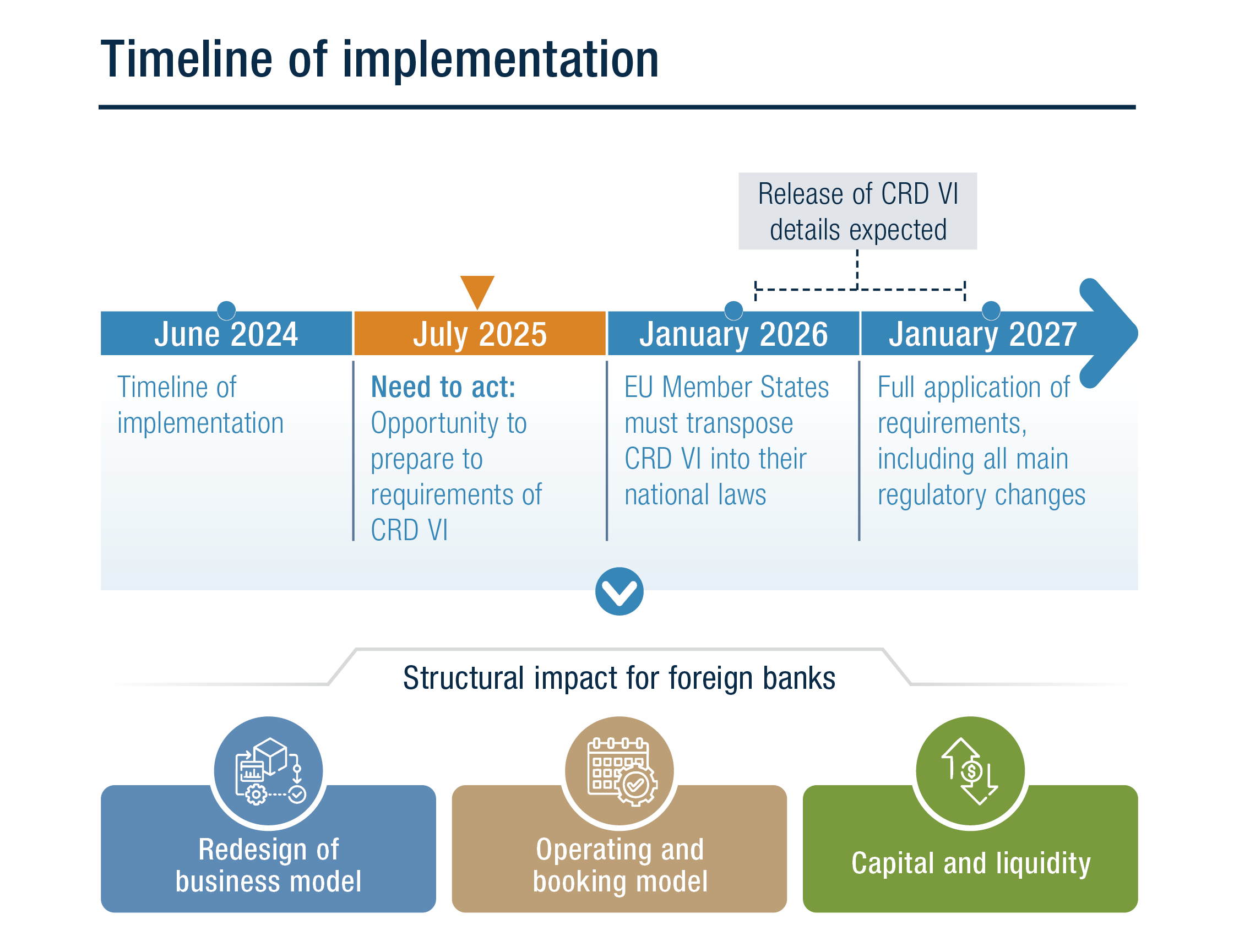

The CRD VI timeline creates a pressing need for action:

- June 2024: Initial timeline for implementation

- July 2025: Strategic window to begin preparations

- January 2026: Member States must transpose CRD VI into national law

- January 2027: Full application, including all major regulatory changes

Firms must use this transitional period to redesign their business models, review operating and booking structures, and recalibrate capital and liquidity frameworks.

Who will be most affected by Article 21c?

The existing market discussions mainly focus on entry-level firms that seek EU market expansion opportunities. The effects of these new regulations will have a more substantial impact on existing EEA-based third-country entities. The upcoming changes will directly impact three primary entities: US banking institutions with investments, UK financial organisations, and Asian and worldwide banking entities. These institutions must determine if their current operational systems will maintain EU legal compliance after mid-2026. The answer in numerous established cases proves to be negative.

Institutions with legacy structures must also revisit how past models align with this new regulatory standard. Article 21c is not limited to new business. Firms must assess whether their existing booking, servicing, and legal entity structures still meet the revised definition of “establishment” in the EU. In many cases, this may trigger a legal, tax, and operational restructuring across multiple jurisdictions.

What about investment services and trading activities?

The entire client servicing system might need a complete redesign. Institutions that provide trading and investment services need to assess whether they must relocate these activities to EU entities and determine the associated regulatory capital requirements. FRTB stands as a lesser known but essential factor in this discussion. Despite the postponement of its implementation until 2027, FRTB continues to influence banks that redesign their presence in the EU. Financial institutions that transfer their trading activities into EU entities because of Article 21c CRD VI requirements will have to hold FRTB capital that exceeds current standards.

Strategic choices: onshore vs offshore

At a strategic level, banks must now choose:

- Remain offshore, risking non-compliance

- Move onshore, absorbing high costs of capital, licensing, infrastructure, and ongoing EU regulatory engagement

Some banks may consider splitting commercial banking from broker-dealer activity, mirroring the structural separation of the Glass-Steagall era. However, such models demand large up-front investments.

There is no single answer —but there are clear starting points

The fundamental reality of Article 21c CRD VI reveals that no single solution exists for all cases. Each financial institution will choose its path based on the combination of its business activities, operational structure, and tolerance for risk. All responses should start with a clear understanding of the regulatory philosophy behind the rule. Supervisors focus on maintaining financial stability as well as maintaining effective oversight while stopping regulatory arbitrage schemes. The requirement for "substance" forces institutions to establish EU-based organisational structures and processes that match their business mix and risk profile.

Five questions every institution should be asking

To build a compliant and sustainable EU structure, firms should start with these five questions:

- What core services are currently being provided cross-border into the EU?

- Under what legal frameworks and contracts?

- Is there any existing EU-authorised presence?

- What is the scope of wholesale and inter-group activity?

- Is reverse solicitation being relied on, and is that sustainable?

Answering these questions will inform both the regulatory strategy and the commercial viability of the operating model —and help clarify what CRD VI Article 21c is in practical terms.

Legal meets operational: from interpretation to execution

The compressed timeline and lack of clarity around Article 21c demand practical expertise, not only for regulatory interpretation but also for operational execution. Institutions that succeed in this transition will share a few defining traits: they will understand the broader impact of Article 21c beyond licensing alone, and they’ll grasp the regulatory intent behind CRD VI. Crucially, they will begin engaging with EU and national regulators early, exploring viable solutions while validating their proposed models.

Compliance won’t hinge on legal analysis alone. Institutions will need to translate interpretation into systems and workflows — rethinking booking processes, compliance protocols, risk frameworks, tax structures, and transfer pricing. The path to implementation will be long, non-linear, and cross-functional.

Success will rely on getting the blend right: regulatory fluency, IT adaptability, operational readiness, and strategic foresight. With the clock ticking, third-country banking groups must move from planning to action, building the structures that will allow them to operate sustainably under the new EU regime.

Final thoughts on CRD VI Article 21c: from compliance to competitive advantage

The regulatory framework for EU-operating third-country banking groups faces a major transformation because of Article 21c CRD VI implementation. The absence of regulatory guidance and the complex nature of the regulation have created confusion among market participants. Institutions that grasp the regulatory philosophy while acting proactively in compliance efforts will successfully handle this transition. Success depends on the integration of strategic foresight with operational readiness, regulatory fluency, and preparedness to handle changes in the regulatory environment.

The implementation of Article 21c CRD VI will create extensive changes for institutions that operate in the EU market. These institutions must transform their current business approaches, risk management approaches, and governance structures because of this regulation. The regulation demands institutions to dedicate substantial resources toward developing their infrastructure and systems, alongside strengthening their regulatory relationships. Institutions that adopt a proactive, strategic compliance approach will both reduce potential risks and leverage all opportunities available through this new regulation.

Article 21c CRD VI represents a key new requirement that will force institutions to meet higher EU regulatory standards, become more transparent, more accountable, and more resilient. Institutions need to adopt both flexibility and innovation, together with customer orientation, to meet the requirements. Institutions that handle these obstacles successfully will fulfil the new regulation requirements while achieving success in their changing market environment. The time for action has arrived, while the countdown continues.

Summary: Why CRD VI Article 21c demands immediate attention

- What is CRD VI Article 21c? It’s a game-changing requirement that redefines how non-EU banks operate in the EU.

- The countdown has started — but the instructions are still missing.

- There’s no one-size-fits-all model, but there is a clear need for action.

- The time to act is now — before the window closes.

How A&M can help

A&M helps banks move from regulation to execution through fully integrated, cross-border teams with experts from the US, UK and EU. We offer regulatory insight, hands-on delivery and a commercial model designed for shared success. Our senior professionals include former regulators and C-suite leaders who work side by side with clients to deliver practical, lasting results.