UAE Corporate Tax and Transfer Pricing

Please complete the below form and a member of the A&M tax team will reach out to discuss your UAE CT and TP obligations.

Contact Us.

On 9 October 2022, the United Arab Emirates’ (UAE) Ministry of Finance (MoF) published Federal Decree Law No. 47 of 2022 (UAE Corporate Tax Law). The UAE Corporate Tax Law applies to Taxable Persons operating in the UAE and is effective for financial years beginning on or after 1 June 2023.

Who Is Subject to UAE Corporate Tax?

A Taxable Person for UAE Corporate Tax purposes can either be a Resident Person or a Non-Resident Person.

A Resident Person is:

- A juridical person incorporated, established or recognized in the UAE, including a Free Zone Person (FZP);[1]

- A foreign juridical person effectively managed and controlled in the UAE; or

- A natural person conducting a business or business activities in the UAE, whose turnover from the business exceeds AED1m in a Gregorian calendar year and does not relate to personal investment income or real estate investment income that is conducted under a license, or legally required to have a license or a commercial business.

A Non-Resident Person is a person who:

- Has a Permanent Establishment (PE) in the UAE;

- Derives state sourced income; or

- Has a nexus in the UAE - (Nexus only applies to juridical persons).

What Are the UAE Corporate Tax Rates?

Under the UAE Corporate Tax Law, a Taxable Person shall be subject to Corporate Tax on their Taxable Income (i.e., accounting income adjusted for exemptions and deductions) at a rate of 0% on Taxable Income up to AED 375,000 and at 9% on Taxable Income above AED 375,000.[2]

Businesses operating in UAE Free Zones will be considered as Qualifying Free Zone Persons (QFZP), and can be eligible for a 0% Corporate Tax rate on their qualifying income where certain conditions are met.

Large multinationals in the UAE with global consolidated revenues of at least EUR 750m (in at least two of the four preceding fiscal years) may be subject to a Domestic Minimum Top-Up Tax (DMTT) of 15% for financial years starting on or after 1 January 2025. DMTT will only apply to multinational enterprises (MNEs).

Refer to our article here for further details on the UAE DMTT rules.

Qualifying Free Zone Person Regime

To be considered as a QFZP, a FZP must meet the following requirements:

- Derive Qualifying Income;

- Maintain adequate substance in the UAE (i.e., a FZP must have its core-income generating activities performed within the Free Zone – this will be assessed on a case-by-case basis with reference to having adequate assets and full-time qualified employees, and incurring adequate operating expenses in the Free Zone);

- Has not elected to opt out of the Free Zone regime;

- Comply with the Transfer Pricing rules and documentation requirements;

- Prepare and maintain audited financial statements; and

- Satisfy the de minimis requirement (i.e., the non-qualifying revenue in a tax period must not exceed the lower of AED5m, or 5% of total revenue).[3]

We recommended seeking tax advice if you are looking to assess whether your business qualifies under the QFZP regime.

Tax Reliefs and Tax Elections

There are several tax reliefs and tax elections that may be available to businesses where the relevant conditions are met. These include:

- Realization basis

- Transition rules

- Loss relief

- Qualifying group relief

- Small business relief and

- Business restructuring relief

Businesses should assess whether any of these reliefs or elections will apply when completing their CT return. Some elections such as the realization basis and transitional rules can only be made in the first tax period. Therefore it is important that businesses take this into consideration.

UAE Transfer Pricing Requirements

On 23 October 2023, the FTA released the UAE Transfer Pricing guide which broadly aligns the UAE Transfer Pricing provisions with the Organization for Economic Cooperation’s Transfer Pricing Guidelines for Multinationals and Tax Administrations (OECD TP Guidelines), highlighting some UAE-specific Transfer Pricing requirements.

With the UAE Corporate Tax Law as the legal basis, the following are the key Articles which govern the UAE Transfer Pricing regulations:

Article 34 – the Arm’s Length Principle (ALP)

Article 35 – Definition of Related Parties and Control

Article 36 – Payments made to Connected Persons

Article 55 – Transfer Pricing documentation

The Transfer Pricing reporting requirements in the UAE include the following:

| Requirement | Qualification thresholds | Submission deadline |

| Local file and Master file | Businesses that are part of an MNE group with a total consolidated group revenue ≥ AED 3.15bn or a business’ whose revenue is ≥ AED 200m for the relevant tax period. | To be submitted within 30 days of the request by the FTA. |

| Disclosure form – Related Parties | The aggregate number of related party transactions is ≥ AED 40m. Each individual transaction above AED 4m must be reported. | Submitted alongside CT return. |

| Disclosure form – Connected Persons | Aggregate value of payments or benefits made to connected persons that are ˃ AED 500m. | |

| Country by Country reporting (CbCR) | Only applicable to MNE groups headquartered in the UAE with consolidated group revenue ≥ AED 3.15bn during the Fiscal Year immediately preceding the reporting Fiscal Year. | 12 months from the end of the accounting period. The CbCR notification must be submitted no later than the last day of the fiscal year. |

Related Party Transactions

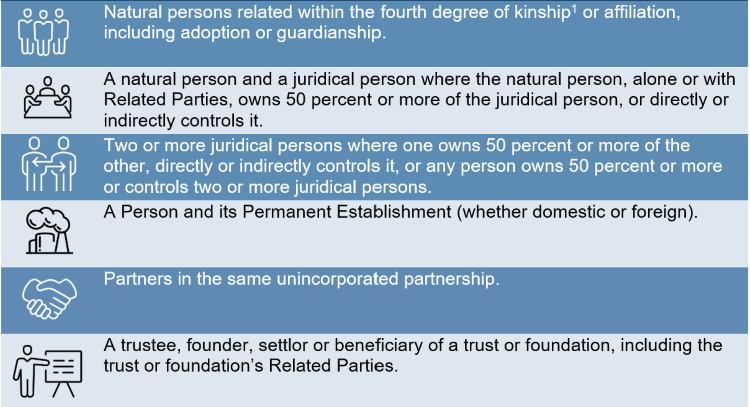

For UAE Transfer Pricing purposes, Related Parties are defined as:

|

Per provisions of Article 35, all related party and connected persons transactions should be priced in accordance with the arm’s length principle including for QFZPs.

The above applies regardless of whether thresholds for preparing a disclosure form, Connected Persons schedule, Local file and/or Master file are met.

Connected Persons

For UAE Transfer Pricing purposes, Connected Persons include:

- Individuals with direct or indirect ownership or control of the Taxable Person;

- A director or officer of the Taxable Person;

- An individual related to the owner or director/officer of the Taxable Person;

- Any partner in an unincorporated partnership; and

- A Related Party to any of the above.

Corporate Tax deductions for any non-arm’s length payments will be denied for Connected Persons. Depending on the nature of the payment, it may also trigger a Corporate Tax liability for the Connected Person.

It should be noted that there is an exemption from the requirement to comply with the Connected Person rules for Taxable Persons listed on a recognized stock exchange or Taxable Persons regulated by a competent authority in the UAE.

Refer to our article here for further details on the UAE Transfer Pricing rules.

Compliance Requirements

- Businesses must register for UAE Corporate Tax within the timeframes set out in FTA decision No.3 of 2024.

- UAE Corporate Tax returns must be filed within nine months of the end of the tax period alongside any Corporate Tax due.

- UAE Transfer Pricing disclosure forms for Related Party transactions and payments/benefits made to Connected Persons must be completed alongside the UAE Corporate Tax return when the thresholds are reached.

- Transfer Pricing documentation – Local files and Master file must be prepared, maintained, and provided to the FTA within 30 days of request.

- Audit readiness: businesses must maintain all tax records and relevant documentation for seven years after the end of the tax period.

Any non-compliance will result in administrative penalties as per Cabinet Decision No. 75 of 2023. Refer to our article here on the UAE Corporate Tax return guide for further information.

At A&M, we can provide the following Corporate Tax and Transfer Pricing Compliance Services:

- UAE Corporate Tax registration/deregistration

- UAE Corporate Tax and Transfer Pricing impact assessments

- UAE Corporate Tax advisory services in relation to the accessibility of tax deductions, exemptions and Corporate Tax elections such as the Qualifying Free Zone Person regime

- UAE Corporate Tax provisioning - preparation of the current and deferred tax provisions for inclusion in a business’ financial statements

- Preparation and filing of UAE Corporate Tax returns including Transfer Pricing disclosure forms

- Preparation of Transfer Pricing documentation (incl. Local files, Master file, and benchmarking)

- UAE Connected Persons advisory and benchmarking

- Support on Corporate Tax and Transfer Pricing audits and inquiries

- UAE Corporate Tax and Transfer Pricing technical training

- Country by Country reporting – preparation of the CbCR file, conversion to XML, and notification support.

Get in touch with us today to learn more about our services and how A&M can support your business in meeting its UAE Corporate Tax and Transfer Pricing obligations.

[1] A juridical person is an entity established or otherwise recognized under the laws and regulations of the UAE, or under the laws of a foreign jurisdiction, that has a legal personality separate from its founders, owners, and directors, such as limited liability companies, foundations, “onshore” trusts, public or private joint stock companies. (Federal Tax Authority FAQs – Corporate Tax – juridical persons.)

[2] Article 3 of the Corporate Tax Law.

[3] Article 18 of the Corporate Tax Law and Article 3 and 5 of Ministerial Decision No. 265 of 2023 Regarding Qualifying Activities and Excluded Activities.