NAVIGATING THE TARIFF SHIFTS: TURNING DISRUPTION INTO OPPORTUNITY

The sudden change in US tariff structure affects several Indian export-oriented industries – textile & apparels, jewelry, seafood, agriculture, chemicals, and automotive among others. This shift has significantly altered the market dynamics for Indian companies, which have traditionally been very competitive compared to global peers. With Indian exports now attracting much higher tariffs than those of competing countries, businesses focused on the US, face an uncertain future. This development highlights a critical reality – overdependence on any single geography is a major risk in today’s interconnected world.

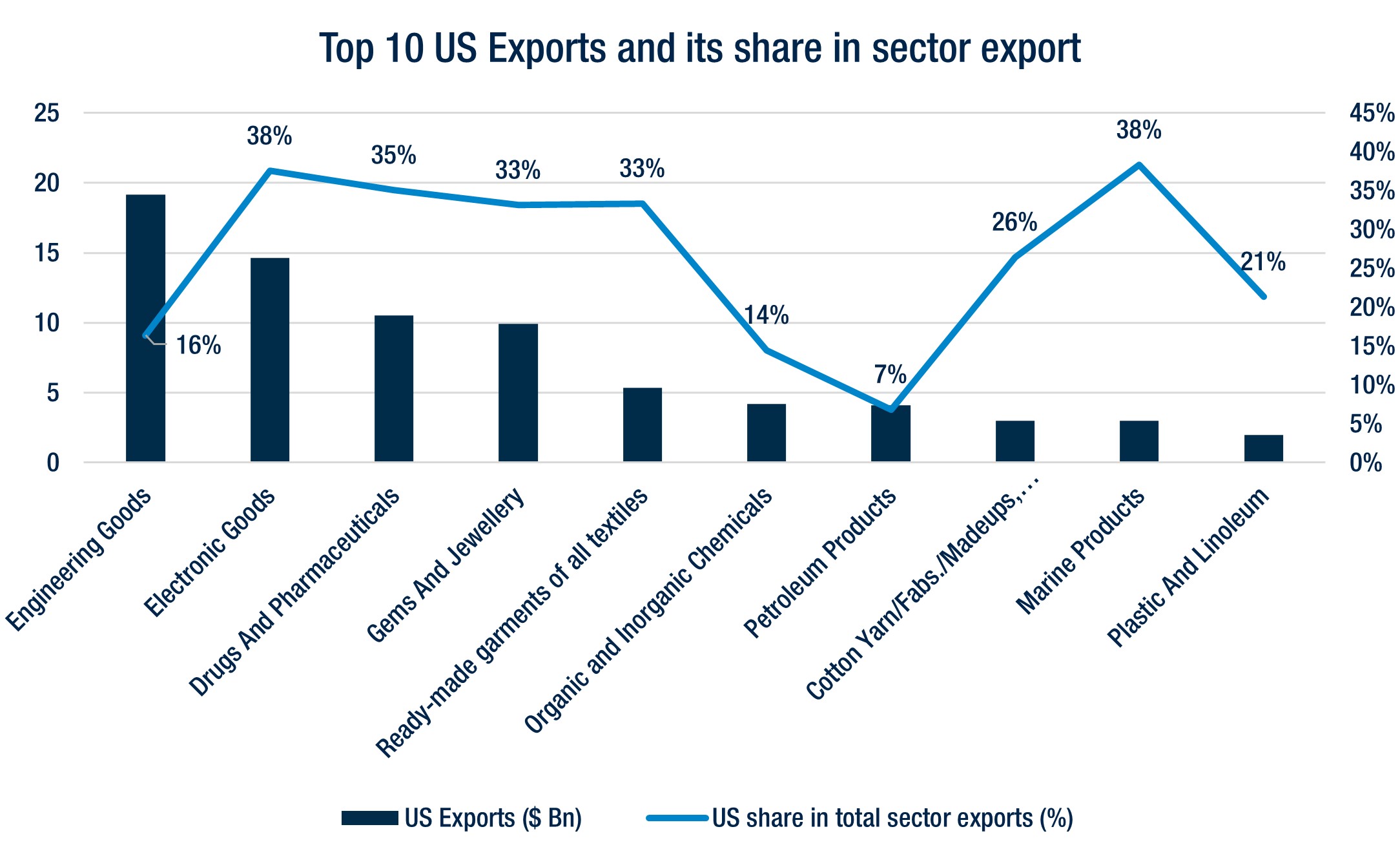

EXHIBIT 1 – Top 10 US Export Industries and US’ Share in Total Sector Export

Source: Niryat.gov.in, A&M analysis PB1]

Source: https://www.usitc.gov/research_and_analysis/tradeshifts/2024/textiles, A&M analysis

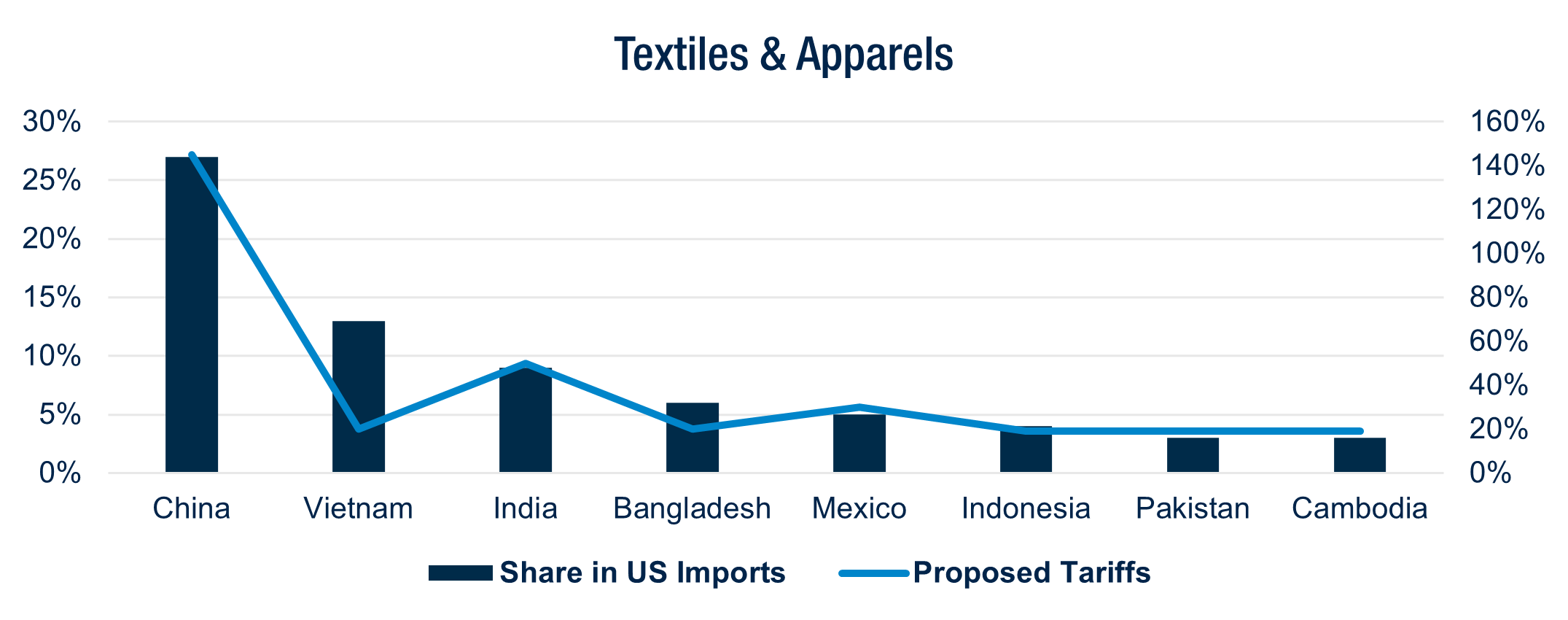

The impact of tariff varies across industries, largely determined by the tariff treatment of competitor countries. For example, gems & jewelry have long been among India’s key exports to the US[1]. India has held an advantage due to its low labor cost, supporting a significant workforce of approximately 4-5 mn people[2]. With the new duties in place, however, work could potentially shift to other geographies – for instance, Botswana & Namibia for loose diamonds (duty free), and silver & gold jewelry to Thailand and Vietnam, as well as to Italy, France, and Jordan which benefit from lower tariffs or Free Trade Agreements (FTA). Similarly, India’s apparel & textile industry faces stiff competition from Bangladesh and Vietnam[4], both of which enjoy much lower tariffs.

To address these challenges, the Indian government has initiated multiple interventions. , that are expected to provide a fillip to Indian companies. In addition, FTA negotiations with UK have been concluded[6], and talks are ongoing with other key global players such as EU, Peru, Chile and more[7]. Other targeted initiatives include export-promotion missions and relief packages to the most affected sectors[9]. Alongside government action, Indian companies must also focus on what they can do internally to insulate themselves from such shocks in the future. Now is the time for companies to have a hard look at their operations and reset their operating models to strengthen competitiveness over medium-to-long term.

Some of the key imperatives include:

1. DIVERSIFY THE CUSTOMER BASE

The most immediate and natural response for affected industries is to diversify their customer base. Companies must evaluate new markets and leverage India’s existing FTAs. There are numerous opportunities across EU, ASEAN, Gulf, Africa and Latin America. The imperative is clear: identify attractive markets, determine white spaces, choose the right operating model, and act decisively.

2. RE-ALIGN THE OPERATING MODEL

Companies must diversify their geographic presence. With the growing global preference for localized production, businesses should explore how much value addition can take place closer to the end customer. Traditionally, Indian manufacturers have kept supply chains centered in India. Now is the time to reimagine the value chain and assess which elements can be moved closer to the customer and which can be relocated to tariff-friendly countries for final value addition. Such moves will strengthen overall supply chain resilience.

3. INTEGRATED COST TAKE-OUT

Companies must take a hard look at operating costs to remain competitive in this new scenario. The time is ripe to undertake integrated cost-reduction programs covering the entire business. Too often, companies focus in isolated initiatives – supply chain, manufacturing, or white-collar productivity – which yield only incremental improvements to the bottom-line. Competing with countries enjoying lower tariffs requires a complete rethink of cost structures. Integrated programs that leverage technology across the business and apply zero-based costing can deliver step-change improvements and restore margins.

4. MOVE TO HIGH VALUE, DIFFERENTIATED OFFERINGS

Companies must develop high-value, differentiated offerings — such as premium fabrics or sustainable seafood — to build resilience against such shocks. Indian firms have traditionally leveraged the labor arbitrage to produce commoditized products in the most cost-effective way. This approach is unsustainable in the long run. To thrive, businesses must move up the value chain and invest in product design and development.

5. DIGITAL AS COMPETITIVE EDGE

Time is ripe to critically examine and deploy digital technologies across the value chain. The effective use of digital and AI can help companies become leaner and more responsive to the ever-changing business requirements. Technology that improves workforce productivity – across both white- and blue- collar – can create a strong competitive edge. However, adoption should be targeted: companies must focus on digital solutions that deliver tangible business benefits.

The disruption caused by tariffs is significant and requires both short- and long-term responses. While the government pursues multiple initiatives – including engagement with the US – companies must take a long-term view and make fundamental changes to how they operate. Only then can they thrive in an increasingly unstable and competitive global environment.

Disclaimer: This document consolidates publicly available data and proprietary market insights. Metrics have been refined where applicable to maintain consistency and relevance. For questions regarding the underlying sources or analytical methodologies, please reach out to the author directly.

[1] https://gjepc.org/solitaire/impact-of-us-reciprocal-tariffs-on-indian-gem-jewellery-exports-kirit-bhansali-chairman-gjepc/

[2] https://indiantradeportal.in/vs.jsp?lang=0&id=0,31,24100,24110#:~:text=The%20gems%20and%20jewellery%20industry,skilled%20workforce%20in%20the%20country

[3] https://gjepc.org/solitaire/indian-gem-jewellery-industry-analyses-u-s-reciprocal-tariff-plans-impact-on-11-58-billion-of-exports/

[4] https://scanx.trade/stock-market-news/corporate-actions/raymond-explores-production-shift-to-vietnam-bangladesh-and-ethiopia-amid-us-tariff-concerns/16253810

[5] https://www.thehindu.com/business/gst-reforms-to-benefit-consumption-growth/article70033494.ece

[6] https://www.gov.uk/government/publications/uk-india-trade-deal-conclusion-summary/uk-india-trade-deal-conclusion-summary

[7] India's trade talks: Piyush Goyal says FTA negotiations going on 'subah se shaam' - with America, Chile, EU & more - Times of India

[8] https://upstox.com/news/business-news/latest-updates/govt-working-to-fast-track-export-promotion-mission-to-cushion-us-tariff-blow-official/article-180355/

[9] https://economictimes.indiatimes.com/news/economy/foreign-trade/india-plans-relief-package-for-exporters-hit-by-us-tariffs/articleshow/123719216.cms?from=mdr