2024 LIFE SCIENCES: SNAPSHOT YEAR IN REVIEW

To give directions to a stranger, you need to know two things – the intended destination and current location. The end of another year provides a crucial moment for reflection – a moment to understand the journey that brought us to our current location – to more accurately anticipate the industry-shaping dynamics of 2025.

It is those who can look in the rearview mirror with an unbiased lens that will be best positioned to strategically plan for the future.

1. AI: The hype is over. The revolution is here!

There are hundreds of companies offering AI-based drug discovery tools, and the rate of AI-enabled medical devices continues to see double-digit growth.

The story of AI is nothing new. More and more companies have boasted about investments and partnerships intended to leverage AI to bring about transformative change. Although these technologies are fascinating, it has been unclear how they would translate from research projects to real applications that ultimately benefited patients.

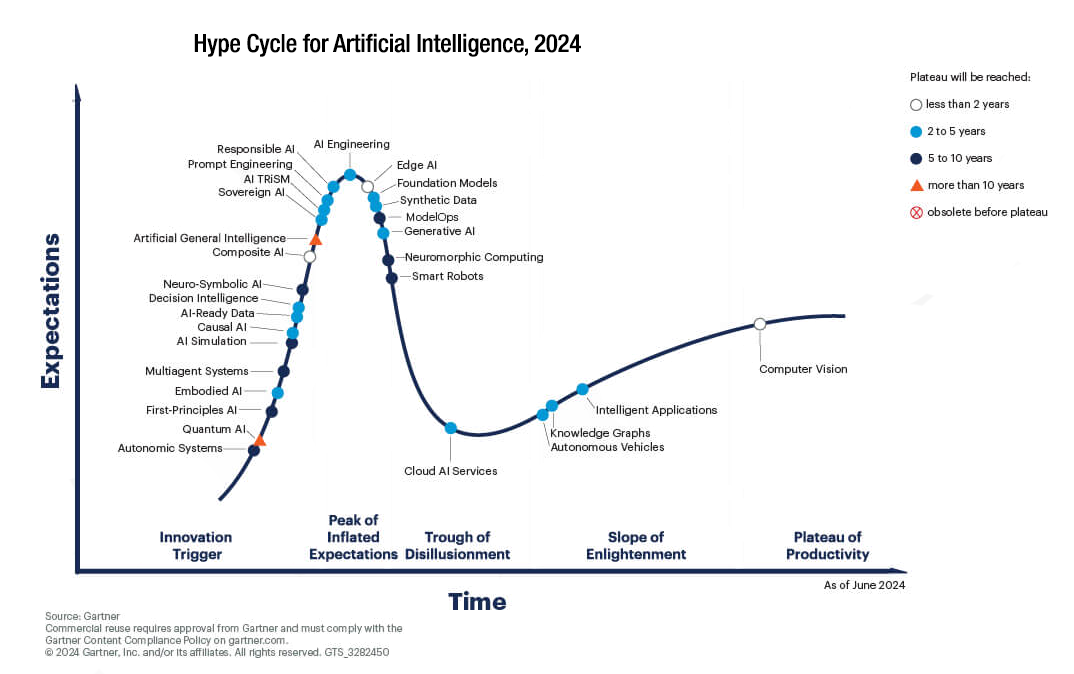

Now, the AI era has arrived. GenAI and foundational modeling have passed the Hype peak of disillusionment.

Concrete, tangible AI use-cases are being tested and proven, leaving companies scrambling to keep up with new algorithms intended to improve organizational performance and patient outcomes. There are 210+ players offering AI-based tools, platforms, and services to support drug discovery. Most notably this year, Google’s DeepMind launched Alphafold 3 to provide research teams the ability to predict 3D structures and interactions of proteins based on their amino acid sequences. Former LinkedIn co-founder Reid Hoffman also just announced the creation of Manas AI, which will be a cancer-focused startup using AI to support drug discovery.

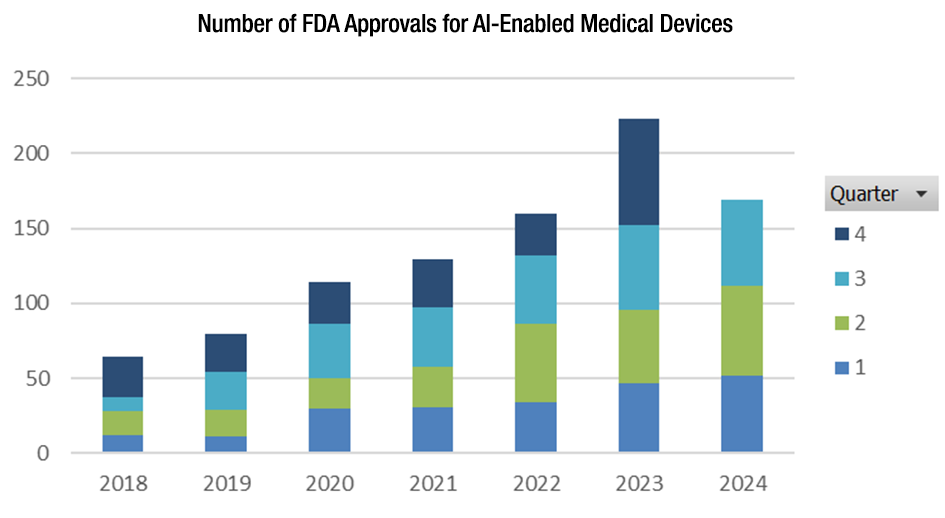

In Medical Device technology, the rate of medical devices with AI and machine-learning technology continues to increase. Although no GenAI-enabled medical devices have yet been approved, the FDA made traction with regulatory guidance in 2024 that will pave the way for Generative AI to enter the playing field.

While it is unclear exactly which AI developments will rise to the top, it is safe to say companies will need to place their bets or risk being left behind. (A&M Life Sciences touched on this in our “Insights from JPM Healthcare Conference” in the AI to ROI section.)

2. See it, treat it. The solution is personalized.

2024 saw a rise in theranostics, a combination of therapy and diagnostics that lets you “see it” in diagnostics and “treat it” in therapy.

Healthcare is making the shift from a “one size fits all” approach that treats the averages toward personalization that factors in patient-specific profiles and environments.

A perfect example is the rise of theranostics, a name derived from the combination of “therapy” and “diagnostics.” Theranostics allow providers to see it and treat it. We can learn more about conditions like cancer: where it is in the body, how it is growing, and how treatment is progressing. We can also treat it more precisely, blasting the cancer cells while preserving the surrounding healthy tissue and ultimately reducing the systemic toxicity experienced by patients.

In 2024, we see players across medtech and pharma investing in theranostics to address key therapeutic areas like oncology and neurology. From medtech players such as GE and Siemens that specialize in diagnostics, to biopharma players like Novartis and Lilly, the industry is rallying around theranostics as a personalized standard of care. Major 2024 deals included Bristol Myers Squibb’s purchase of RayzeBio for $4.1B, Novartis’ $1B purchase of Mariana Oncology, and Telix’s $230M acquisition of RLS and its 31 radiopharmacies – but activity in the space goes far beyond these individual datapoints. Strategic partnerships, co-development deals, and in-licensing are further bolstering the market, leading to vertical integration as companies seek to solidify their competitive positioning and accelerated growth towards the next generation of these technologies.

It is unclear whether the slurry of dealmaking in radiopharmaceuticals and theranostics will continue in 2025. However, as this area further develops we can expect an increase in the push for expanded patient access. To find commercial success, companies will need to align payer and provider incentives to accelerate the transition of theranostics to the center of the care journey and open the door to a truly personalized patient experience.

3. A lifestyle-driven approach to healthcare.

The days of patients passively following a doctor’s orders is fading. Individuals are taking charge of their health – and it starts with losing those last few pounds.

2024 was the year of lifestyle and wellness, with major launches and readouts that led to two new players topping the charts as biopharma’s largest companies by market capitalization, Novo Nordisk and Eli Lilly. These companies have seen massive success in the incretin market, with 45% YOY growth in Q4’24.

However, the race is on. 2024 saw multiple new Big Pharma entrants into obesity through strategic bolt-on M&A deals, and differentiation will no longer be about sheer quantity of weight loss but rather the quality of weight loss. Competition will be fierce as companies seek to dethrone the current duopoly.

More importantly, it is more and more clear that patients are taking control of their care. Never before have patients so actively sought out a treatment with the hopes of improving their overall wellness. As many as one in eight adults (12%) say they have taken a GLP-1 agonist – including 6% who say they are currently taking such a drug. While America’s obesity problem is likely a contributing factor to this high rate of utilization, the prospects of a thinning waist is driving patients to take control of their health.

4. Transparency is the new trust builder.

Transparency is now king in healthcare. With average US healthcare costs rising 7% in 2024 and prescription costs up 13%, patients are demanding more transparency with providers and health plans to understand where their money is going. Despite these cost increases, there is little evidence to suggest improved outcomes in the US relative to other high-income countries.

The Federal Trade Commission’s (FTC) report on pharmacy benefit managers (PBMs) near the end of summer was a trigger for widespread scrutiny to our healthcare system that ultimately led to multiple proposed pieces of legislation intended to dismantle the Big 3 PBMs. At the same time, new and innovative companies like Mark Cuban’s Cost Plus Drug Co. received attention and praise for their transparent cost-plus approach to pricing. Even Big Pharma entered the ring with direct-to-consumer (DTC) models such as LillyDirect and PfizerForAll that have the potential to shake up the current drug delivery care model. We are likely to see these trends continue in the year ahead.

Patients are unsatisfied with the current US health system, and the outrage reached a critical and tragic breaking point with the attack on UnitedHealthcare’s CEO. Extreme public debate ensued, with a cry that can’t be ignored: patients don’t trust the infrastructure intended to keep them healthy. (A&M Life Sciences touched on this in our “Insights from JPM Healthcare Conference” in the Consumer Health Empowerment section.)

This widespread distrust is going to require significant effort to resolve, but it’s not impossible. Integrating transparency into company initiatives, operations, and pricing will be one step toward answering the public outcry and healing the relationship between those who serve and those who are served.

Conclusion

In 2024, Life Sciences saw tremendous innovation that will bring significant advancements to the clinic. More notably, however, 2024 was a reminder of who is at the center of the industry – the patient. It’s a reminder that while shareholders and other ecosystem players are important to keep the system running, everything is ultimately intended to serve the patient.

As we ramp up 2025, companies should use this time to reflect on how they have lived out their missions and how they can re-align their operations and strategic priorities to better meet the needs of patients. It is no longer enough to simply publish a patient-centered mission statement on a website – patients need to feel and see the commitment to serving their personalized needs through action.

Sources:

- Hype Cycle for Artificial Intelligence 2024 | Gartner

- https://www.rootsanalysis.com/reports/ai-based-drug-discovery-market.html

- Artificial Intelligence and Machine Learning (AI/ML)-Enabled Medical Devices | FDA

- https://www.biopharmadive.com/news/healthcare-venture-captial-funding-ai-boost-2024-silicon-valley-bank/736902/

- Bristol Myers Squibb Completes Acquisition of RayzeBio, Adding Differentiated Actinium-Based Radiopharmaceutical Platform

- Novartis enters agreement to acquire Mariana Oncology, strengthening radioligand therapy pipeline | Novartis

- https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/

- https://investor.lilly.com/news-releases/news-release-details/lilly-provides-update-2024-revenue-guidance-announces-2025

- https://abcnews.go.com/US/unitedhealthcare-ceo-shooting-prompts-questions-prevent-copycats/story?id=116870982

- https://www.ftc.gov/system/files/ftc_gov/pdf/pharmacy-benefit-managers-staff-report.pdf

- https://www.commonwealthfund.org/publications/fund-reports/2024/sep/mirror-mirror-2024